In the evolving landscape of water management, Xylem Inc. (XYL) and American Water Works Company, Inc. (AWK) are prominent players within their respective sectors. Xylem specializes in engineered water solutions and technologies, while American Water focuses on regulated water and wastewater services across the United States. Both companies share a commitment to innovation and sustainability, addressing critical water challenges in a world facing increasing demand. With both firms vying for leadership in this essential industry, which company is better positioned to capitalize on the growing needs of the water sector?

Company Overview

Xylem Inc. Overview

Xylem Inc. is a leading player in the industrial machinery sector, specializing in engineered solutions for water and wastewater management. Headquartered in Rye Brook, New York, the company operates through three main segments: Water Infrastructure, Applied Water, and Measurement & Control Solutions. Xylem’s mission is to address the global water crisis by providing innovative technologies and products that enhance water quality and conservation. With a market capitalization of approximately $36.5 billion, Xylem serves diverse markets, including municipal, industrial, and commercial clients worldwide. The company emphasizes sustainability and efficiency, leveraging advanced analytics and smart technologies to optimize water use.

American Water Works Company, Inc. Overview

American Water Works Company, Inc. is the largest publicly traded water and wastewater utility in the United States, serving roughly 14 million people across 24 states. Founded in 1886 and headquartered in Camden, New Jersey, the company is dedicated to providing safe and reliable water services. Its core mission revolves around delivering essential water and wastewater services to residential, commercial, and industrial customers while maintaining a commitment to environmental stewardship. With a market capitalization of approximately $25.3 billion, American Water operates numerous treatment plants and extensive distribution networks, ensuring compliance with regulatory standards and promoting community wellness.

Key Similarities and Differences in Business Models

Both Xylem and American Water Works operate within the water sector, targeting different aspects of the industry. Xylem focuses on manufacturing and providing advanced technologies and equipment for water management, while American Water Works is primarily engaged in delivering water and wastewater services. Their business models reflect a shared commitment to sustainability, yet differ in execution; Xylem’s approach centers on innovation and product development, whereas American Water emphasizes service provision and infrastructure management.

Income Statement Comparison

The following table provides a comparison of the most recent income statements for Xylem Inc. (XYL) and American Water Works Company, Inc. (AWK), highlighting key financial metrics.

| Metric | Xylem Inc. (XYL) | American Water Works (AWK) |

|---|---|---|

| Revenue | 8.56B | 4.68B |

| EBITDA | 1.69B | 2.67B |

| EBIT | 1.13B | 1.88B |

| Net Income | 890M | 1.05B |

| EPS | 3.67 | 5.39 |

In 2024, Xylem Inc. demonstrated substantial revenue growth, rising by approximately 16.5% compared to the previous year, while its Net Income also increased by around 46%. In contrast, American Water Works realized a more modest revenue growth of 10.6% and a Net Income increase of about 27%. Notably, Xylem’s EBITDA margin improved, indicating enhanced operational efficiency, while AWK maintained a stable margin. Overall, Xylem’s performance reflects a robust growth trajectory, whereas AWK exhibits a steady but slower growth pattern in comparison.

Financial Ratios Comparison

In this section, I provide a comparative analysis of key financial ratios for Company A (Xylem Inc.) and Company B (American Water Works Company, Inc.) based on the most recent fiscal year data.

| Metric | Xylem Inc. (XYL) | American Water Works (AWK) |

|---|---|---|

| ROE | 12.34% | 16.27% |

| ROIC | 9.87% | 14.12% |

| P/E | 31.63 | 26.99 |

| P/B | 2.64 | 2.60 |

| Current Ratio | 1.75 | 0.39 |

| Quick Ratio | 1.33 | 0.35 |

| D/E | 0.20 | 1.37 |

| Debt-to-Assets | 0.13 | 0.41 |

| Interest Coverage | 22.93 | 3.28 |

| Asset Turnover | 0.52 | 0.14 |

| Fixed Asset Turnover | 7.43 | 0.17 |

| Payout Ratio | 39.33% | 56.66% |

| Dividend Yield | 1.24% | 2.41% |

Interpretation of Financial Ratios

Xylem Inc. demonstrates strong profitability with a higher asset turnover and interest coverage ratio, indicating efficient use of assets and an excellent ability to meet interest obligations. However, its P/E ratio suggests it may be overvalued compared to American Water Works, which has a better return on equity and a higher dividend yield, but a significantly higher debt-to-equity ratio, raising concerns about financial leverage. Investors should weigh these factors carefully when considering their portfolios.

Dividend and Shareholder Returns

Xylem Inc. (XYL) pays a dividend with a payout ratio of approximately 39.3%, reflecting a steady annual yield of around 1.24%. The company’s recent dividend trend shows a consistent increase, supported by strong free cash flow. However, the risk of unsustainable payouts remains, particularly if earnings falter.

American Water Works Company (AWK) also distributes dividends, with a payout ratio of about 56.4% and a yield of 2.41%. Their strategy includes share buybacks, which can enhance shareholder value, but the reliance on debt to finance these activities may pose risks. Overall, both companies’ dividend policies support potential long-term value creation, albeit with caution regarding the sustainability of their payouts and financial leverage.

Strategic Positioning

Xylem Inc. (XYL) and American Water Works Company Inc. (AWK) operate in the water services sector, each holding significant market shares but catering to different segments. Xylem focuses on engineered products and solutions for water and wastewater applications, while AWK provides regulated water and wastewater services to millions of customers across various states. The competitive pressure is substantial, with both companies facing challenges from technological disruptions and evolving regulatory standards. Xylem’s innovation in smart technologies enhances its market position, while AWK’s extensive infrastructure and service contracts secure its customer base. Risk management remains crucial as both companies navigate market volatility and environmental concerns.

Stock Comparison

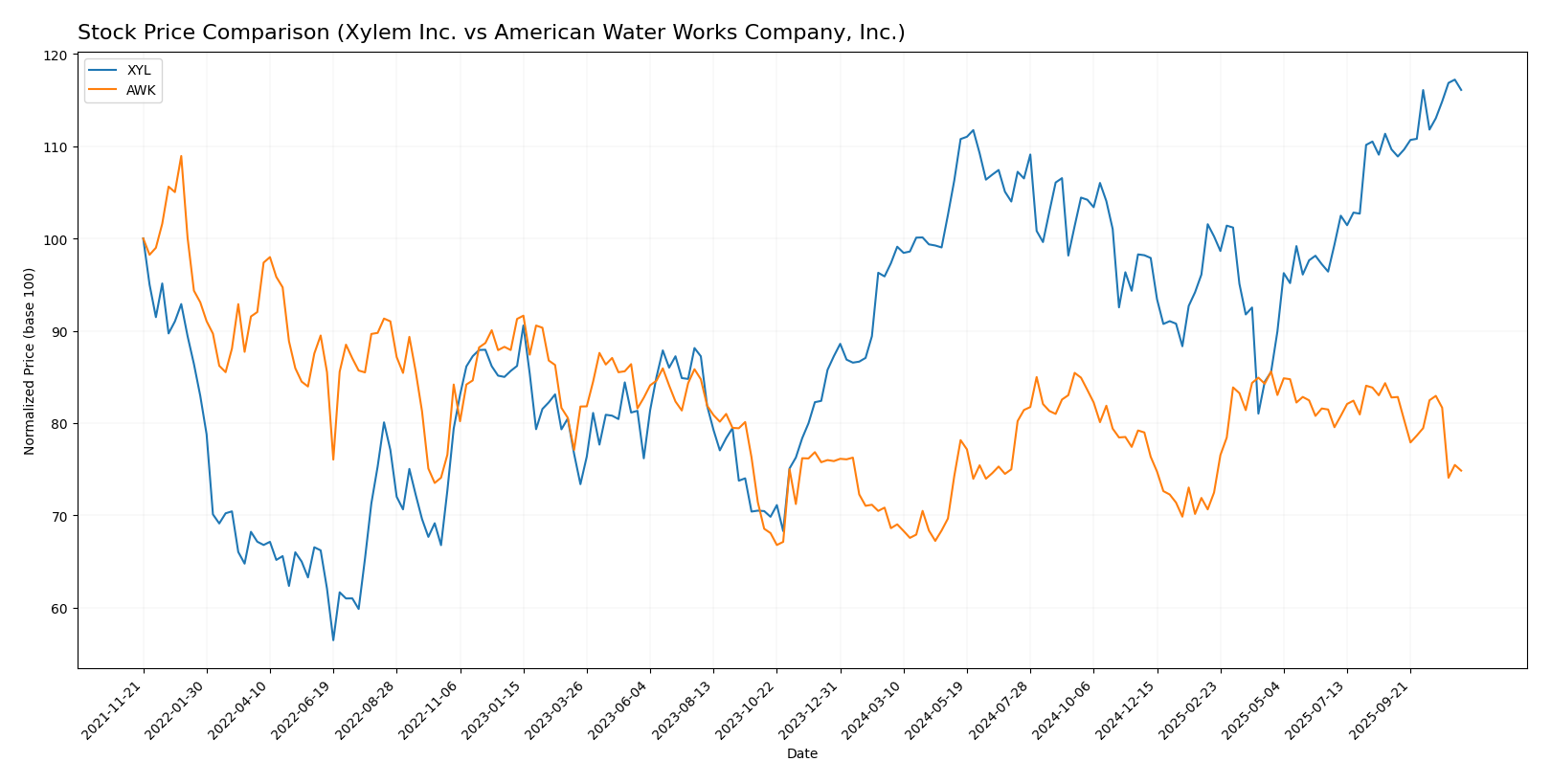

In analyzing the stock performance of Xylem Inc. (XYL) and American Water Works Company, Inc. (AWK) over the past year, we observe significant price movements and trading dynamics that can inform investment decisions.

Trend Analysis

Xylem Inc. (XYL) has demonstrated a substantial price change of 33.05% over the past year, indicating a bullish trend. The stock has experienced notable acceleration in its price movement, with a high of $151.31 and a low of $104.60. The standard deviation of 10.44 suggests a moderate level of volatility, which is typical for a stock showing strong upward momentum. Recently, from August 31 to November 16, 2025, XYL’s price increased by 5.87%, further substantiating its bullish trajectory.

On the other hand, American Water Works Company, Inc. (AWK) has reported a price change of -1.36% over the same timeframe, categorizing its trend as neutral. Despite this classification, the trend is showing signs of deceleration. The stock reached a high of $148.40 and a low of $116.57 during the year, with a standard deviation of 9.14, indicating some volatility. Notably, AWK’s recent price decline of 9.57% from August 31 to November 16, 2025, reflects a shift in market sentiment that requires careful consideration.

In summary, XYL’s bullish trend and acceleration contrast with AWK’s neutral trend and recent downturn, highlighting the importance of vigilance in portfolio management and stock selection.

Analyst Opinions

Recent analyst recommendations for Xylem Inc. (XYL) indicate a “Buy” rating, with analysts emphasizing its solid return on assets and stable cash flow, despite some concerns about its debt levels. Analysts such as those from Morningstar have noted its potential for growth in the water management sector. Conversely, American Water Works Company, Inc. (AWK) has also received a “Buy” rating, with analysts such as those at S&P Global highlighting its strong return on assets and overall financial health. The consensus for both companies in 2025 is a “Buy,” reflecting positive market sentiment.

Stock Grades

In this section, I will provide the latest stock ratings for Xylem Inc. (XYL) and American Water Works Company, Inc. (AWK), based on the most recent data from reputable grading companies.

Xylem Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2025-11-06 |

| Barclays | Maintain | Overweight | 2025-10-29 |

| RBC Capital | Maintain | Outperform | 2025-10-29 |

| Stifel | Maintain | Buy | 2025-10-29 |

| Citigroup | Maintain | Buy | 2025-10-29 |

| Citigroup | Maintain | Buy | 2025-10-09 |

| Mizuho | Maintain | Neutral | 2025-09-12 |

| TD Cowen | Maintain | Hold | 2025-08-26 |

| UBS | Maintain | Buy | 2025-08-05 |

| Stifel | Maintain | Buy | 2025-08-01 |

American Water Works Company, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Jefferies | Upgrade | Hold | 2025-11-05 |

| Barclays | Maintain | Underweight | 2025-10-21 |

| Argus Research | Maintain | Buy | 2025-08-14 |

| UBS | Maintain | Neutral | 2025-08-12 |

| Wells Fargo | Maintain | Equal Weight | 2025-08-01 |

| Mizuho | Maintain | Neutral | 2025-08-01 |

| UBS | Maintain | Neutral | 2025-07-11 |

| Barclays | Maintain | Underweight | 2025-07-10 |

| Wells Fargo | Maintain | Equal Weight | 2025-05-02 |

| Evercore ISI Group | Maintain | In Line | 2025-05-02 |

Overall, Xylem Inc. continues to receive consistent “Buy” or “Overweight” ratings from multiple analysts, indicating strong confidence in the stock. Conversely, American Water Works has seen a recent upgrade to “Hold” from Jefferies, suggesting a cautious optimism, although other analysts maintain a more conservative outlook with “Underweight” ratings.

Target Prices

The consensus target prices for Xylem Inc. (XYL) and American Water Works Company, Inc. (AWK) reflect optimistic expectations from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Xylem Inc. (XYL) | 178 | 160 | 171.71 |

| American Water Works (AWK) | 145 | 134 | 140.33 |

For Xylem Inc., the target consensus of $171.71 is notably higher than its current price of $149.87. Similarly, American Water Works shows a target consensus of $140.33, which exceeds its current price of $129.77. This indicates a general optimism among analysts regarding the future performance of these stocks.

Risk Analysis

In the table below, I outline the key risks associated with Xylem Inc. (XYL) and American Water Works Company, Inc. (AWK) based on the most recent data.

| Metric | Xylem Inc. (XYL) | American Water Works (AWK) |

|---|---|---|

| Market Risk | Medium | Medium |

| Regulatory Risk | High | High |

| Operational Risk | Medium | Medium |

| Environmental Risk | High | Medium |

| Geopolitical Risk | Medium | Medium |

Both companies face similar risks, particularly regulatory and environmental challenges, which can significantly impact their operations and profitability. Recent regulations targeting water quality and infrastructure improvements may impose additional costs and operational changes, making these risks particularly relevant.

Which one to choose?

When comparing Xylem Inc. (XYL) and American Water Works Company, Inc. (AWK), both companies exhibit solid fundamentals, but their trajectories differ. XYL has shown substantial revenue growth, with a recent gross profit margin of 37.5% and a net profit margin of 10.4%. Its debt levels are moderate, reflected in a debt-to-equity ratio of 0.20. However, it trades at a higher P/E ratio of 31.6, suggesting a potential overvaluation.

In contrast, AWK has a better overall rating of B+ compared to XYL’s B, indicating stronger financial stability and growth prospects. Despite a recent price drop of 1.36%, AWK maintains a solid profit margin of 22.4% and a more attractive dividend yield of 2.40%.

For growth-oriented investors, XYL may offer more potential, while those preferring stability and reliable dividends might lean towards AWK.

However, both companies face industry risks, including competition and market dependence.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

Discover my two complete analyses of American Water Works and Xylem: