In the competitive landscape of financial services, two giants stand out: American Express Company (AXP) and Visa Inc. (V). While both companies operate within the credit services industry, they adopt distinct strategies to capture market share and innovate. American Express focuses on providing premium charge and credit card products and travel-related services, whereas Visa excels in facilitating digital payments through its expansive global network. As we delve deeper into their business models, which company is better positioned to navigate the evolving financial landscape?

Company Overview

American Express Company Overview

American Express Company (AXP) is a leading global financial services corporation, recognized for its charge and credit card products, as well as a comprehensive suite of travel-related services. Founded in 1850 and headquartered in New York City, the company operates through three primary segments: Global Consumer Services, Global Commercial Services, and Global Merchant and Network Services. This multifaceted business model enables American Express to cater to a diverse clientele, offering a range of payment and financing products, merchant acquisition services, and customer loyalty programs. With a market capitalization of approximately $260 billion, American Express is strategically positioned in the financial services sector, focusing on premium customer experiences and robust fraud prevention measures.

Visa Inc. Overview

Visa Inc. (V) is a prominent payments technology company, globally recognized for facilitating digital payments among consumers, merchants, and financial institutions. Established in 1958 and headquartered in San Francisco, Visa operates its proprietary transaction processing network, VisaNet, which authorizes, clears, and settles payment transactions efficiently. With a market capitalization of nearly $654 billion, Visa offers an extensive range of card products and value-added services, including strategic partnerships that enhance payment experiences, such as its recent agreement with Ooredoo in Qatar. Visa’s strong brand recognition and operational scale position it as a leader in the financial services industry, continuously innovating to meet the evolving demands of the digital economy.

Key Similarities and Differences

Both American Express and Visa operate within the financial services sector, primarily focusing on credit and payment solutions. They both emphasize security and customer loyalty, albeit through different approaches. American Express is renowned for its premium offerings and direct relationships with consumers, often targeting affluent customers, while Visa operates primarily as a network facilitator, enabling transactions for a broader range of financial institutions and businesses. This fundamental difference in business models shapes their respective market strategies and customer engagement, reflecting their unique positions within the competitive landscape of payment services.

Income Statement Comparison

The following table compares the most recent income statements of American Express Company (AXP) and Visa Inc. (V), providing insights into their financial performance.

| Metric | American Express (AXP) | Visa (V) |

|---|---|---|

| Revenue | 74.20B | 40.00B |

| EBITDA | 14.57B | 26.00B |

| EBIT | 12.89B | 24.78B |

| Net Income | 10.13B | 20.06B |

| EPS | 14.04 | 10.36 |

In the most recent year, American Express showed robust revenue growth of approximately 10% year-over-year, indicating strong demand for its services. Visa also demonstrated solid performance with revenue growth of about 11.4%. However, while American Express’s net income margins improved slightly, Visa maintained its impressive margin levels, reflecting operational efficiency. Overall, both companies continue to exhibit resilience and growth potential despite varying market conditions, underscoring their strength in the financial services sector.

Financial Ratios Comparison

The following table provides a comparison of the most recent financial ratios for American Express Company (AXP) and Visa Inc. (V), allowing investors to assess their financial health and operational efficiency.

| Metric | American Express (AXP) | Visa Inc. (V) |

|---|---|---|

| ROE | 16.80% | 35.54% |

| ROIC | 8.87% | 20.52% |

| P/E | 20.89 | 32.97 |

| P/B | 6.99 | 17.44 |

| Current Ratio | 0.26 | 1.08 |

| Quick Ratio | 0.26 | 1.08 |

| D/E | 1.69 | 0.66 |

| Debt-to-Assets | 18.82% | 25.27% |

| Interest Coverage | 1.56 | 45.09 |

| Asset Turnover | 0.27 | 0.40 |

| Fixed Asset Turnover | 12.02 | 9.44 |

| Payout ratio | 19.74% | 23.10% |

| Dividend yield | 0.94% | 0.70% |

Interpretation of Financial Ratios

The financial ratios reveal distinct strengths and weaknesses between AXP and V. Visa demonstrates superior efficiency with higher ROE, ROIC, and interest coverage ratios, indicating robust profitability and lower financial risk. Conversely, AXP’s lower current and quick ratios raise liquidity concerns. While AXP maintains a respectable payout ratio, Visa’s ratios suggest a more favorable capital management strategy. Investors should weigh these factors carefully when considering investments in either company.

Dividend and Shareholder Returns

American Express (AXP) has a solid dividend strategy, evidenced by a payout ratio of approximately 20% and a dividend yield of about 0.94%. Their consistent annual dividends, coupled with a robust free cash flow, suggest sustainable distributions. Visa Inc. (V), while also offering dividends, has a lower yield of around 0.78% and a payout ratio of 21%. Both companies engage in share buybacks, enhancing shareholder value. Overall, their approaches appear conducive to long-term value creation.

Strategic Positioning

In the competitive landscape of financial services, American Express (AXP) and Visa (V) hold significant market positions. Visa leads with a market cap of approximately $654 billion, benefiting from its expansive transaction network, VisaNet, which facilitates efficient digital payments globally. American Express, with a market cap of around $260 billion, specializes in premium card offerings and travel-related services, catering to a distinct clientele. Technological advancements intensify competitive pressure, as both companies strive to innovate and enhance payment solutions. However, Visa’s broader acceptance and partnerships provide a competitive edge, while American Express focuses on customer loyalty and unique service offerings.

Stock Comparison

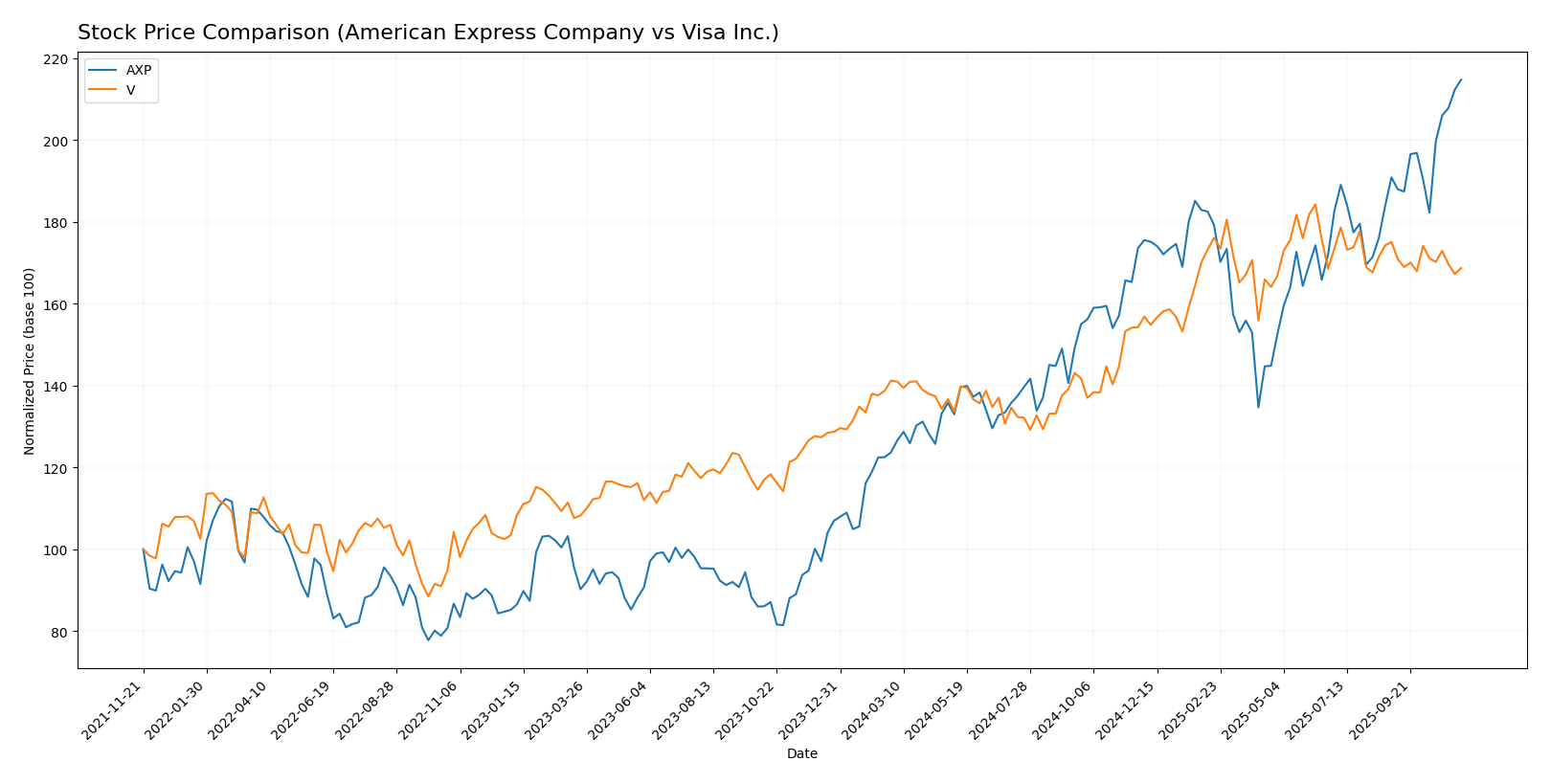

Over the past year, the stock prices of American Express Company (AXP) and Visa Inc. (V) have exhibited significant fluctuations, reflecting varying trading dynamics and shifts in investor sentiment.

Trend Analysis

American Express Company (AXP) has demonstrated a remarkable price change of +100.88% over the past 12 months. This indicates a strong bullish trend, characterized by acceleration in its price movements. Notably, the stock reached a high of 372.77 and a low of 182.04, with a standard deviation of 45.03 signifying substantial volatility. Recently, from August 31, 2025, to November 16, 2025, AXP experienced a 12.52% increase, with a trend slope of 4.08, further affirming the ongoing bullish trajectory.

Conversely, Visa Inc. (V) has recorded a price change of +31.13% over the same period, which also suggests a bullish trend, albeit with signs of deceleration. The stock’s highest price was 370.22, and the lowest was 258.43, accompanied by a standard deviation of 34.73. However, in the recent analysis period from August 31, 2025, to November 16, 2025, V faced a decline of -3.67%, with a trend slope of -0.56, indicating a potential shift in momentum despite the overall positive yearly performance.

Analyst Opinions

Recent analyst recommendations for American Express (AXP) and Visa (V) both indicate a rating of B+. Analysts highlight strong return on equity and return on assets for both companies, signaling solid operational performance. However, concerns arise around their price-to-earnings ratios and debt management. Notably, analysts recommend a “buy” for both AXP and V, suggesting confidence in their growth potential for this year. The consensus for 2025 remains a “buy,” reflecting optimism in their market positions and financial health.

Stock Grades

In the current market landscape, let’s examine the latest stock ratings for American Express Company (AXP) and Visa Inc. (V) to inform your investment decisions.

American Express Company Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Freedom Capital Markets | upgrade | Hold | 2025-10-24 |

| BTIG | maintain | Sell | 2025-10-20 |

| Barclays | maintain | Equal Weight | 2025-10-20 |

| Truist Securities | maintain | Buy | 2025-10-20 |

| Wells Fargo | maintain | Overweight | 2025-10-20 |

| JP Morgan | maintain | Neutral | 2025-10-07 |

| UBS | maintain | Neutral | 2025-10-07 |

| Barclays | maintain | Equal Weight | 2025-10-06 |

| Keefe, Bruyette & Woods | maintain | Outperform | 2025-10-01 |

| Evercore ISI Group | maintain | In Line | 2025-09-30 |

Visa Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Macquarie | maintain | Outperform | 2025-10-29 |

| UBS | maintain | Buy | 2025-10-29 |

| Raymond James | maintain | Outperform | 2025-10-29 |

| Baird | maintain | Outperform | 2025-10-06 |

| Truist Securities | maintain | Buy | 2025-08-04 |

| Macquarie | maintain | Outperform | 2025-07-31 |

| Barclays | maintain | Overweight | 2025-07-31 |

| Morgan Stanley | maintain | Overweight | 2025-07-30 |

| UBS | maintain | Buy | 2025-07-30 |

| Truist Securities | maintain | Buy | 2025-07-17 |

Overall, the grades for American Express indicate a mix of stability and caution, with a notable upgrade to “Hold” from Freedom Capital Markets. In contrast, Visa maintains strong recommendations across the board, with multiple firms reiterating their “Outperform” and “Buy” ratings, suggesting confidence in its continued performance.

Target Prices

The consensus target prices for American Express Company (AXP) and Visa Inc. (V) reflect positive analyst expectations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| American Express (AXP) | 400 | 295 | 349.22 |

| Visa Inc. (V) | 425 | 398 | 412.25 |

For American Express, the current stock price of $372.77 is slightly below the consensus target of $349.22, suggesting moderate growth potential. In contrast, Visa’s stock price of $338.88 is well below its consensus target of $412.25, indicating stronger upside expectations from analysts.

Risk Analysis

In this section, I will outline the potential risks associated with investing in American Express Company (AXP) and Visa Inc. (V). Below is a summary table of the key risks for both companies.

| Metric | American Express Company (AXP) | Visa Inc. (V) |

|---|---|---|

| Market Risk | High due to economic fluctuations affecting consumer spending | Moderate, with stable demand for digital payments |

| Regulatory Risk | Increased scrutiny on financial services and consumer protection | Regulatory changes impacting payment processing |

| Operational Risk | Dependence on technology and cybersecurity threats | Risks related to transaction processing failures |

| Environmental Risk | Limited, but potential impact from climate change initiatives | Moderate, with scrutiny on supply chain sustainability |

| Geopolitical Risk | Exposure to international markets can be affected by trade tensions | Moderate, as global operations may face political instability |

Both American Express and Visa face significant market and regulatory risks, particularly as consumer behavior shifts and as regulations evolve. Specific concerns include rising competition in digital payments and increased scrutiny of financial practices, making it essential for investors to closely monitor these developments.

Which one to choose?

When comparing American Express Company (AXP) and Visa Inc. (V), both companies exhibit strong fundamentals, with AXP showing a higher gross profit margin (81.9%) compared to V’s 77.3%, indicating better efficiency in generating profit from revenues. However, Visa boasts a more favorable net profit margin (50.1% vs. 13.7%), reflecting its ability to retain earnings.

In terms of valuation, AXP trades at a price-to-earnings ratio of 20.89, while Visa’s is significantly higher at 32.97, suggesting that AXP may present a better opportunity relative to its earnings. Analyst ratings for both companies are solid, with a B+ rating, but AXP’s recent stock trend shows a bullish acceleration, while Visa’s trend indicates deceleration.

Investors focused on growth may prefer Visa for its higher profit retention, while those prioritizing value and stability might find AXP more attractive. Note that both companies face risks related to increasing competition and market dependence.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

Discover my two comprehensive analyses of American Express and Visa: