1️⃣ Introduction — Context and Key Issue

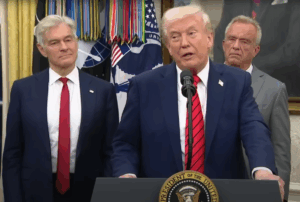

Recent escalations in U.S.-China trade tensions are igniting market volatility as both nations adopt a more confrontational stance ahead of a significant meeting between President Donald Trump and President Xi Jinping. This renewed conflict, marked by threats of increased tariffs and export controls, could have substantial ramifications for global markets and economic stability.

2️⃣ Key Facts — Summary of Recent Developments

– 🟩 Global economy: Intensified trade tensions reignite concerns over global supply chains and economic growth.

– 🟦 U.S. highlights: President Trump threatened a 100% tariff on Chinese imports, contributing to a 2.7% drop in the S&P 500 and a 3.5% decline in the Nasdaq. In pre-market trading, indices rebounded, partially recovering losses as Trump clarified his position.

– 🟨 Chinese responses: China announced new controls on rare earth exports, conducted an antitrust investigation against Qualcomm, and imposed fees on U.S.-built ships in retaliation for previous U.S. tariffs.

3️⃣ Analysis and Interpretation

The resurgent trade aggression from both the U.S. and China appears to be a strategic maneuver ahead of the upcoming APEC summit, as each leader seeks to project strength domestically. This revival of tariffs and regulatory measures marks a shift from recent attempts at calming tensions, indicating that underlying economic frictions remain unresolved. The S&P 500’s recent downturn suggests investor fatigue and uncertainty, especially given the backdrop of prior record highs supported by rising AI sector enthusiasm.

Markets remain sensitive to developments in trade negotiations, with analysts suggesting that these tensions will continue to create volatility. The swift market response to Trump’s dual messaging—initially aggressive, later conciliatory—underscores the fragility of investor sentiment in the current geopolitical landscape.

4️⃣ Market Impact

– Equities: The market’s recent resilience halted as technology sectors were particularly hard hit by tariff threats, although a modest recovery indicates potential investor optimism.

– Currencies: The dollar’s stability against the euro reflects ongoing cautious sentiment, while speculative responses to trade news create fluctuations in currency pairs.

– Commodities: Mining stocks showed strength as rare earth tensions prompted increased demand prospects; firms like Eramet and ArcelorMittal saw significant gains.

– Rates: Bond yields exhibited a mixed response, with U.S. yields reflecting uncertainty, while yields on French bonds remained stable despite domestic political challenges.

5️⃣ Scenarios or Outlook

🎯 Base scenario: Continued trade negotiations lead to a temporary calming in tensions, allowing markets to stabilize.

⚠️ Alternative scenario: An escalation in tariffs could trigger a sharper market correction and increased volatility across equities and foreign exchange.

🚀 Optimistic scenario: Successful diplomacy at the APEC summit might result in reduced trade barriers, boosting market confidence.

6️⃣ Conclusion — Final Takeaway

The revival of trade tensions between the U.S. and China highlights the precarious balance of international relations and its direct impact on market dynamics. While investor optimism remains tentative, the potential for a diplomatic resolution at the forthcoming summit could offer a glimmer of stability amidst the storm.