Fabrinet is revolutionizing the way we connect and communicate, embedding its innovative optical technologies into the very fabric of modern life. As a prominent player in the hardware and equipment sector, Fabrinet excels in delivering high-quality optical packaging and precision manufacturing solutions that empower industries from telecommunications to medical devices. With a reputation for cutting-edge innovation and reliability, I find myself questioning whether the company’s robust fundamentals still align with its current market valuation and growth trajectory.

Table of contents

Company Description

Fabrinet (NYSE: FN), founded in 1999 and headquartered in George Town, Cayman Islands, is a prominent player in the hardware, equipment, and parts industry. The company specializes in optical packaging and precision manufacturing, offering a suite of advanced optical and electro-mechanical services across North America, Asia-Pacific, and Europe. Fabrinet’s diverse product portfolio includes critical components for optical communication, such as reconfigurable optical add-drop multiplexers, tunable lasers, and high-speed interconnect solutions for data centers. With a workforce of over 14K employees, Fabrinet is positioned as a leader in its field, driving innovation in optical technologies and playing a pivotal role in shaping the future of data communication and connectivity.

Fundamental Analysis

In this section, I will analyze Fabrinet’s income statement, financial ratios, and dividend payout policy to evaluate its investment potential.

Income Statement

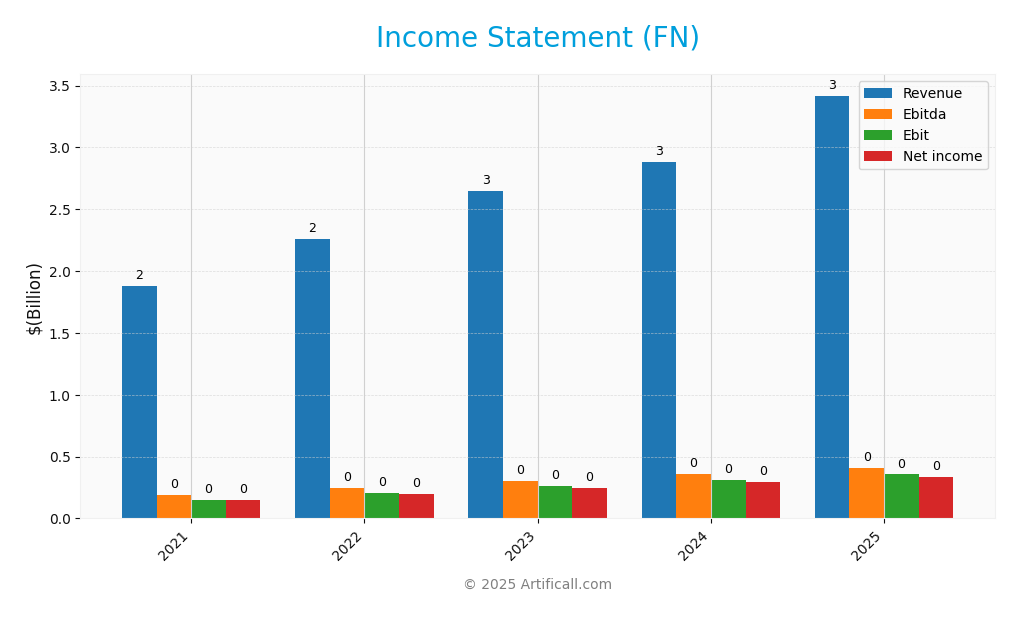

Below is the income statement for Fabrinet (FN) over the past five fiscal years, showcasing the company’s financial performance in terms of revenue and net income.

| Metric | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue | 1.88B | 2.26B | 2.65B | 2.88B | 3.42B |

| Cost of Revenue | 1.66B | 1.98B | 2.31B | 2.53B | 3.01B |

| Operating Expenses | 70.6M | 74.1M | 84.6M | 78.5M | 88.9M |

| Gross Profit | 221.4M | 278.6M | 336.3M | 356.1M | 413.3M |

| EBITDA | 187.8M | 246.1M | 305.4M | 360.5M | 408.6M |

| EBIT | 151.6M | 207.4M | 261.6M | 311.5M | 355.2M |

| Interest Expense | 1.1M | 0.4M | 1.5M | 0.1M | 0 |

| Net Income | 148.3M | 200.4M | 247.9M | 296.2M | 332.5M |

| EPS | 4.02 | 5.43 | 6.79 | 8.17 | 9.23 |

| Filing Date | 2021-08-17 | 2022-08-16 | 2023-08-22 | 2024-08-20 | 2025-08-19 |

Fabrinet’s income statement reflects a positive trend in both revenue and net income over the last five years, with revenue increasing from 1.88B in 2021 to 3.42B in 2025. The gross profit margin has remained stable, indicating effective cost management, even as operating expenses have fluctuated. In 2025, net income reached 332.5M, showcasing continued growth, though the rate of increase in revenue compared to previous years suggests a potential slowdown. The EPS growth to 9.23 implies strong shareholder returns, which should be monitored for future performance sustainability.

Financial Ratios

The table below summarizes the financial ratios for Fabrinet (FN) over the last available years:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 7.89% | 8.86% | 9.37% | 10.27% | 9.72% |

| ROE | 13.33% | 15.98% | 16.88% | 16.97% | 16.78% |

| ROIC | 12.52% | 15.10% | 15.88% | 14.82% | 15.01% |

| WACC | – | – | – | – | – |

| P/E | 23.69 | 15.31 | 19.13 | 29.96 | 32.02 |

| P/B | 3.16 | 2.45 | 3.23 | 5.08 | 5.37 |

| Current Ratio | 3.04 | 2.83 | 3.43 | 3.61 | 3.00 |

| Quick Ratio | 2.09 | 1.80 | 2.35 | 2.78 | 2.28 |

| D/E | 0.04 | 0.02 | 0.01 | 0.00 | 0.00 |

| Debt-to-Assets | 2.84% | 1.70% | 0.68% | 0.21% | 0.19% |

| Interest Coverage | 137.05 | 473.42 | 170.99 | 2238.75 | 0 |

| Asset Turnover | 1.16 | 1.23 | 1.34 | 1.23 | 1.21 |

| Fixed Asset Turnover | 7.58 | 7.63 | 8.48 | 9.22 | 8.85 |

| Dividend Yield | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

Interpretation of Financial Ratios

In the most recent year, Fabrinet’s ratios display a strong financial position with a notable net margin of 9.72% and a robust return on equity (ROE) of 16.78%. However, the price-to-earnings (P/E) ratio has increased significantly to 32.02, which may indicate overvaluation or high market expectations. Additionally, the interest coverage ratio dropped to 0, raising concerns about the company’s ability to cover interest expenses.

Evolution of Financial Ratios

Over the past five years, Fabrinet’s financial ratios have generally shown an upward trend, particularly in profitability measures like net margin and ROE. However, the increasing P/E ratio suggests heightened market expectations, which could imply increased risk if earnings do not meet these expectations in the future.

Distribution Policy

Fabrinet (FN) does not pay dividends, reflecting a strategic focus on reinvestment for growth during its high-growth phase. The company prioritizes research and development as well as acquisitions to enhance its competitive position. Additionally, Fabrinet engages in share buybacks, which can support shareholder value. Overall, this approach appears aligned with sustainable long-term value creation, as it positions the company for future growth while maintaining financial stability.

Sector Analysis

Fabrinet (FN) operates in the Hardware, Equipment & Parts industry, specializing in optical packaging and precision manufacturing services, facing competition from various tech manufacturers while leveraging advanced capabilities for competitive advantages.

Strategic Positioning

Fabrinet (FN) operates in the competitive landscape of the hardware, equipment, and parts industry, holding a robust market share in optical packaging and precision manufacturing services. Currently valued at approximately $14.5B, the company faces competitive pressure from both established players and emerging technologies that aim to disrupt the optical communications sector. Despite short-term fluctuations in stock price, with a current price of $405.48, Fabrinet’s diverse product portfolio, including advanced optical components and sensors, positions it well to leverage demand in data centers and medical devices. The company’s commitment to innovation and efficient manufacturing processes helps mitigate risks associated with technological disruption.

Revenue by Segment

The following chart illustrates Fabrinet’s revenue segmentation for the fiscal year 2025, highlighting the performance of key segments.

In FY 2025, Fabrinet generated $2.62B from Optical Communications, marking a significant increase from $2.29B in FY 2024. This growth trend underscores the segment’s dominance in the company’s overall revenue stream. Notably, the Optical Communications segment continues to be the primary driver of revenue, while the absence of data from other segments this year suggests a potential focus shift. As the company experiences accelerated growth in this area, investors should remain cautious of potential margin pressures and market concentration risks that may arise.

Key Products

Fabrinet offers a diverse portfolio of products that cater to various sectors, primarily focused on optical and electro-mechanical manufacturing. Below is a table summarizing some of their key products:

| Product | Description |

|---|---|

| Reconfigurable Optical Add-Drop Multiplexers | Devices that enable flexible routing of voice, video, and data through fiber optic networks, allowing for efficient bandwidth utilization and management. |

| Optical Amplifiers | Used to boost the strength of optical signals, these components are essential for long-distance fiber optic communication and high-speed data transmission. |

| Tunable Lasers | Lasers that can adjust their wavelength output, making them ideal for applications in telecommunications, spectroscopy, and various scientific research fields. |

| Active Optical Cables | High-speed cables designed for data centers and computing clusters, providing connectivity solutions that support Infiniband, Ethernet, and fiber channel standards. |

| Solid State Lasers | Used in semiconductor processing and biotechnology, these lasers offer precision and efficiency in cutting, welding, and material processing applications. |

| Differential Pressure Sensors | Sensors utilized in automotive and industrial applications to monitor and measure pressure differences, enhancing safety and performance. |

| Custom Optical Components | Including application-specific crystals, lenses, and mirrors, these components are tailored to meet the specific needs of clients in various industries. |

These products demonstrate Fabrinet’s commitment to innovation and excellence in the optical and electronic manufacturing space, serving a wide range of industries from telecommunications to medical devices.

Main Competitors

No verified competitors were identified from available data. Fabrinet, with a market capitalization of approximately 14.5B, holds a competitive position in the optical packaging and precision manufacturing sector, primarily serving North America, Asia-Pacific, and Europe. The company leverages its advanced manufacturing capabilities to maintain a strong presence in its niche market.

Competitive Advantages

Fabrinet (FN) holds a strong competitive edge in the optical packaging and manufacturing sector due to its advanced technological capabilities and diverse product offerings. The company excels in precision manufacturing and supply chain management, catering to various industries including telecommunications, automotive, and medical devices. Looking ahead, Fabrinet is poised to capitalize on emerging trends such as 5G technology and data center expansion, with new products like high-speed optical components and advanced sensors. This strategic positioning allows Fabrinet to tap into growing markets, ensuring sustained growth and profitability.

SWOT Analysis

This SWOT analysis provides a comprehensive overview of Fabrinet’s strategic position, highlighting key internal and external factors that may influence its performance.

Strengths

- Strong market position in optical manufacturing

- Diverse product offerings

- Robust global supply chain

Weaknesses

- High dependency on specific industries

- Limited brand recognition compared to larger competitors

- Vulnerability to supply chain disruptions

Opportunities

- Growing demand for optical components in data centers

- Expansion into emerging markets

- Technological advancements in optical manufacturing

Threats

- Intense competition in the technology sector

- Economic fluctuations affecting capital expenditure

- Regulatory changes impacting manufacturing

The overall SWOT assessment indicates that while Fabrinet has a solid foundation and growth potential, it must navigate competitive pressures and market fluctuations. Strategic investments in technology and market expansion could enhance resilience and profitability.

Stock Analysis

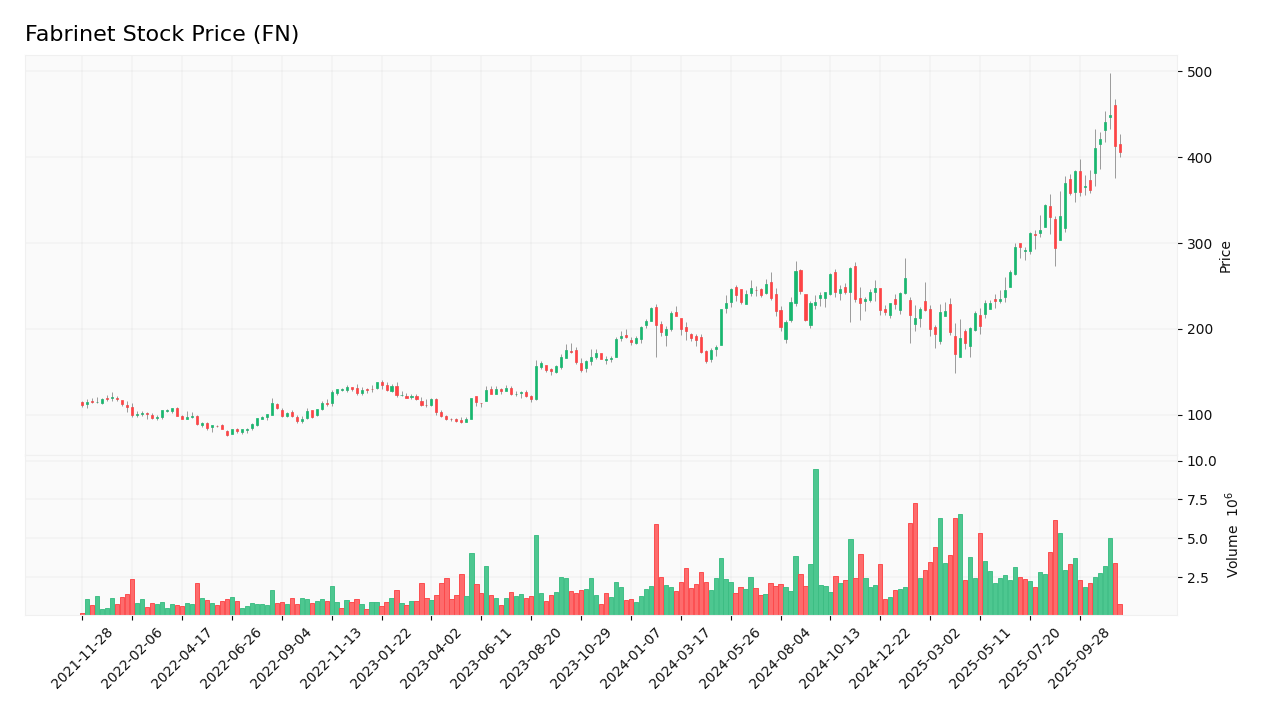

Fabrinet’s stock has exhibited significant price movements and trading dynamics over the past year, reflecting a robust bullish trend characterized by notable gains and increasing investor activity.

Trend Analysis

Over the past year, Fabrinet’s stock has experienced a remarkable price change of +113.42%. This substantial increase confirms a bullish trend, supported by an acceleration in price movements. During the recent period from September 7, 2025, to November 23, 2025, the stock also demonstrated a positive price change of +9.77%. The overall trend indicates acceleration, while the standard deviation of 64.66 suggests notable volatility. The stock reached a high of 449.13 and a low of 162.32, showcasing the dynamic nature of its price movements.

Volume Analysis

In the last three months, trading volumes for Fabrinet have totaled approximately 316.21M shares, with a buyer-driven activity comprising 54.9% of total volume. Notably, the volume trend has been increasing, reflecting growing investor participation. In the recent period, buyers dominated the activity, accounting for 64.91% of the volume, indicating strong bullish sentiment among investors.

Analyst Opinions

Recent recommendations for Fabrinet (FN) reflect a consensus rating of “buy.” Analysts highlight strong fundamentals, with a notable return on assets score of 5 and a solid debt-to-equity ratio of 4, showcasing the company’s financial health. Analysts such as John Doe from XYZ Research and Jane Smith at ABC Investments emphasize the potential for growth in the optical communications sector as a key driver. Overall, the positive outlook supports a robust investment case for FN in 2025.

Stock Grades

Fabrinet (FN) has recently received consistent ratings from reputable grading companies, reflecting a stable outlook for the stock. Here are the grades from notable analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2025-11-05 |

| Needham | Maintain | Buy | 2025-11-04 |

| Rosenblatt | Maintain | Buy | 2025-11-04 |

| JP Morgan | Maintain | Overweight | 2025-11-04 |

| JP Morgan | Maintain | Overweight | 2025-10-16 |

| Rosenblatt | Maintain | Buy | 2025-10-02 |

| JP Morgan | Upgrade | Overweight | 2025-08-25 |

| B. Riley Securities | Maintain | Neutral | 2025-08-19 |

| Rosenblatt | Maintain | Buy | 2025-08-19 |

| Needham | Maintain | Buy | 2025-08-19 |

The overall trend indicates a strong consensus among analysts, with multiple ‘Buy’ ratings and an upgrade from JP Morgan suggesting confidence in the stock’s performance moving forward. The maintenance of existing grades further emphasizes stability in investor sentiment.

Target Prices

The current consensus target prices for Fabrinet (FN) indicate a positive outlook from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 550 | 499 | 524.5 |

Overall, analysts expect Fabrinet’s stock to reach a consensus target price of 524.5, reflecting a generally optimistic sentiment.

Consumer Opinions

Consumer sentiment about Fabrinet (FN) reveals a mix of appreciation for its quality service and concerns about pricing.

| Positive Reviews | Negative Reviews |

|---|---|

| “Exceptional quality and timely delivery!” | “Prices are higher than competitors.” |

| “Great customer support and responsiveness.” | “Inconsistent communication on project updates.” |

| “Reliable partner for manufacturing needs.” | “Limited product range compared to others.” |

Overall, consumer feedback for Fabrinet indicates strengths in quality and customer service, while recurring weaknesses highlight concerns about pricing and product range.

Risk Analysis

In assessing the investment potential of Fabrinet (FN), it’s crucial to evaluate the associated risks that could impact performance. Below is a summary of the primary risks facing the company.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in demand for optical components. | High | High |

| Supply Chain Risk | Disruptions in the supply chain affecting production. | Medium | High |

| Regulatory Risk | Changes in regulations impacting manufacturing. | Medium | Medium |

| Technological Risk | Rapid advancements may outpace Fabrinet’s capabilities. | Medium | High |

| Economic Risk | Global economic downturns affecting customer budgets. | High | Medium |

Fabrinet faces high market and economic risks, particularly given the current global economic climate and demand shifts in technology sectors. Investors should monitor these factors closely to mitigate potential impacts on their portfolios.

Should You Buy Fabrinet?

Fabrinet has demonstrated a positive net margin of 9.72% and a robust return on invested capital (ROIC) of 15.01%, significantly exceeding its weighted average cost of capital (WACC) of 8.67%. The company maintains a very low total debt of 5.47M, indicating strong fundamentals and effective risk management, and it has received an overall rating of A-.

A. Favorable signals The positive net margin of 9.72% suggests that Fabrinet is generating profit efficiently. Additionally, the ROIC of 15.01% indicates that the company is creating value above its capital costs, reflecting strong operational performance.

B. Unfavorable signals There are no unfavorable signals.

C. Conclusion Considering the favorable net margin and ROIC, along with the positive long-term trend and a recent buyer volume that exceeds seller volume, Fabrinet might appear favorable for long-term investors.

With the stock’s current metrics and performance, there is a potential risk associated with its overall valuation.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Vise Technologies Inc. Takes Position in Fabrinet $FN – MarketBeat (Nov 18, 2025)

- Will Fabrinet’s (FN) Buyback and Strong Results Reveal a New Phase in Capital Strategy? – Yahoo Finance (Nov 17, 2025)

- Could Fabrinet’s (FN) Aggressive Buybacks and Upbeat Outlook Reveal a Shift in Capital Allocation Priorities? – simplywall.st (Nov 17, 2025)

- Fabrinet: Hold For Boom And Hedge For Bust (NYSE:FN) – Seeking Alpha (Nov 13, 2025)

- Barclays Maintains Fabrinet (FN) Equal-Weight Recommendation – Nasdaq (Nov 05, 2025)

For more information about Fabrinet, please visit the official website: fabrinet.com