Astera Labs, Inc. is revolutionizing the semiconductor landscape, significantly enhancing how cloud and AI infrastructures operate. With its Intelligent Connectivity Platform, the company delivers cutting-edge solutions that empower businesses to seamlessly deploy high-performance systems at scale. Known for its commitment to innovation and quality, Astera Labs is not just another player in the tech sphere; it is shaping the future of connectivity. As we delve into this investment analysis, the critical question remains: do Astera Labs’ fundamentals still justify its impressive market valuation?

Table of contents

Company Description

Astera Labs, Inc. (NASDAQ: ALAB), founded in 2017 and headquartered in Santa Clara, California, specializes in semiconductor-based connectivity solutions tailored for cloud and AI infrastructures. The company has crafted an Intelligent Connectivity Platform that encompasses a diverse range of data, network, and memory connectivity products, all designed on a unified software-defined architecture. With a market capitalization of approximately $23.5B, Astera Labs positions itself as a key player within the semiconductor industry, focusing on high-performance solutions that facilitate large-scale cloud and AI deployments. As a challenger in the tech sector, Astera Labs is instrumental in driving innovation and efficiency in the rapidly evolving landscape of connectivity technology.

Fundamental Analysis

In this section, I will analyze Astera Labs, Inc.’s income statement, key financial ratios, and dividend payout policy to evaluate its financial health and investment potential.

Income Statement

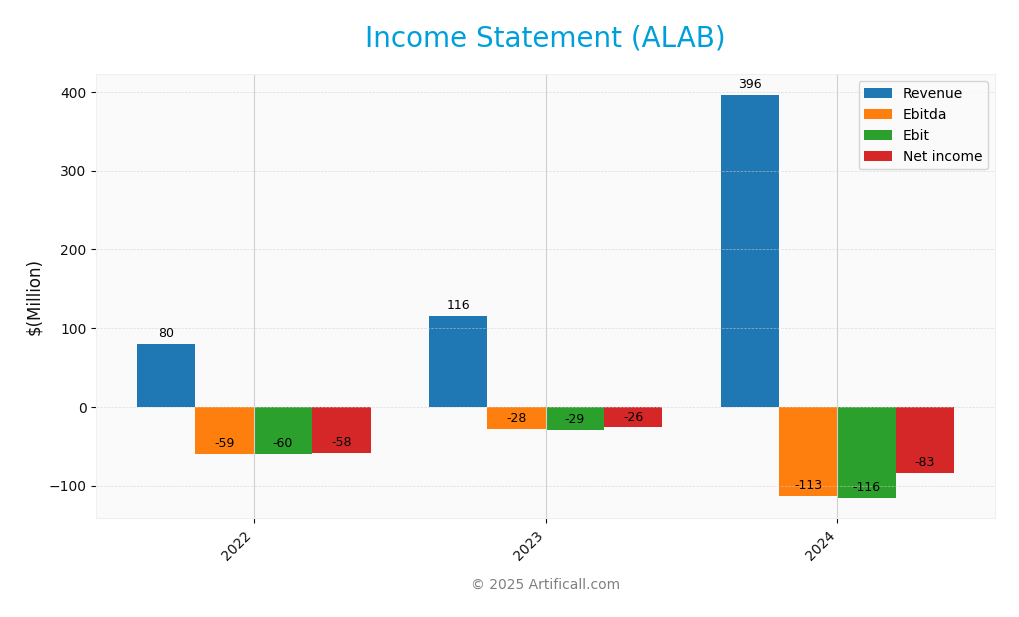

The following table summarizes the income statement for Astera Labs, Inc. over the last three fiscal years, providing insight into its financial performance.

| Metric | 2022 | 2023 | 2024 |

|---|---|---|---|

| Revenue | 79.87M | 115.79M | 396.29M |

| Cost of Revenue | 21.19M | 35.97M | 93.59M |

| Operating Expenses | 118.88M | 109.32M | 418.77M |

| Gross Profit | 58.68M | 79.83M | 302.70M |

| EBITDA | -59.39M | -27.72M | -112.91M |

| EBIT | -60.19M | -29.50M | -116.07M |

| Interest Expense | 0 | 0 | 0 |

| Net Income | -58.35M | -26.26M | -83.42M |

| EPS | -0.45 | -0.17 | -0.64 |

| Filing Date | 2022-12-31 | 2023-12-31 | 2025-02-14 |

Over the three-year period, Astera Labs saw significant growth in Revenue, soaring from 79.87M in 2022 to 396.29M in 2024. However, this growth was accompanied by increasing Operating Expenses, which rose sharply to 418.77M in 2024, indicating a substantial investment in scaling operations. This resulted in a worsening EBITDA and EBIT, reflecting challenges in translating revenue growth into profitability. In 2024, the company’s Net Income deteriorated to -83.42M, suggesting that while revenue growth is promising, cost management remains a critical concern for future performance.

Financial Ratios

The following table summarizes the key financial ratios for Astera Labs, Inc. over the last three available fiscal years.

| Ratio | 2022 | 2023 | 2024 |

|---|---|---|---|

| Net Margin | -73.05% | -22.68% | -21.05% |

| ROE | -34.35% | -16.68% | -8.65% |

| ROIC | -35.21% | -20.66% | -12.20% |

| WACC | N/A | N/A | N/A |

| P/E | -36.33 | -87.72 | -208.41 |

| P/B | 12.48 | 14.63 | 18.02 |

| Current Ratio | 5.14 | 5.30 | 11.71 |

| Quick Ratio | 4.42 | 4.61 | 11.21 |

| D/E | 0.01 | 0.02 | 0.003 |

| Debt-to-Assets | 0.009 | 0.015 | 0.003 |

| Interest Coverage | 0 | 0 | 0 |

| Asset Turnover | 0.38 | 0.59 | 0.38 |

| Fixed Asset Turnover | 15.10 | 15.27 | 11.12 |

| Dividend Yield | 0% | 0% | 0% |

Interpretation of Financial Ratios

For 2024, Astera Labs shows concerning financial ratios, particularly with a negative net margin of -21.05% and a P/E ratio of -208.41, indicating significant losses relative to its share price. The current and quick ratios are strong at 11.71 and 11.21, respectively, suggesting excellent short-term liquidity. However, the lack of profitability and increasing debt levels could pose risks for future performance.

Evolution of Financial Ratios

Over the past three years, Astera Labs’ financial ratios reflect a trend of increasing liquidity (current and quick ratios) while profitability remains a challenge, with consistently negative net margins. The company’s debt levels have remained relatively low, but concerns about overall profitability persist.

Distribution Policy

Astera Labs, Inc. does not pay dividends, primarily due to its negative net income and ongoing reinvestment strategy aimed at fostering growth. Instead, the company is likely prioritizing R&D and acquisitions to enhance its market position. Although there are no dividends, Astera Labs engages in share buybacks, which can support share price by reducing supply. This approach, while risky, potentially aligns with long-term shareholder value creation if the growth strategies yield positive returns.

Sector Analysis

Astera Labs, Inc. operates in the semiconductor industry, focusing on connectivity solutions for cloud and AI infrastructure, facing competition from established players while leveraging its software-defined architecture as a competitive advantage.

Strategic Positioning

Astera Labs, Inc. (ALAB) operates within the competitive semiconductor industry, focusing on connectivity solutions for cloud and AI infrastructures. With a market capitalization of approximately $23.5B, Astera holds a significant position, but faces intense competition from established players. The company’s Intelligent Connectivity Platform differentiates it through its software-defined architecture, allowing for scalable high-performance operations. Current benchmarking indicates a need to innovate continuously to address technological disruptions and maintain market share, as the sector evolves rapidly. I remain cautious about potential competitive pressures that could impact growth.

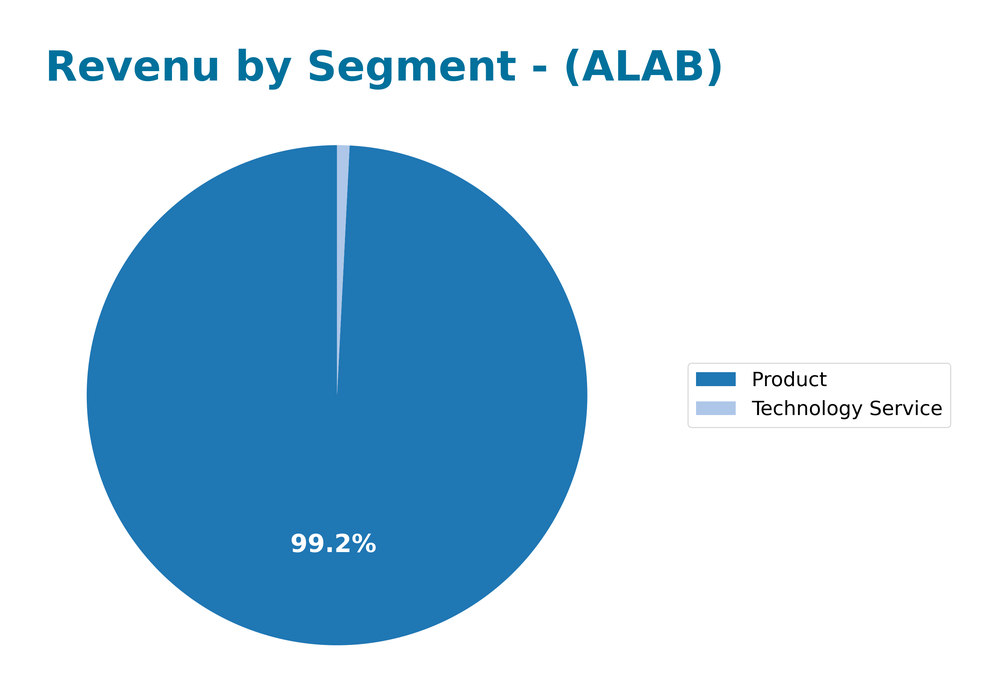

Revenue by Segment

The chart below illustrates the revenue distribution by segment for Astera Labs, Inc. for the fiscal year ending December 31, 2024.

In 2024, Astera Labs generated a total revenue of approximately 396.4M, with the Product segment contributing 393.1M and the Technology Service segment adding 3.2M. The Product segment overwhelmingly drives the business, reflecting a robust demand for their offerings, while the Technology Service segment remains relatively minor. Overall, the revenue growth may indicate stability; however, the heavy reliance on the Product segment poses concentration risks. The modest contribution from Technology Services suggests potential for diversification, but growth in this area remains slow.

Key Products

Astera Labs, Inc. offers a range of innovative products designed to support advanced semiconductor connectivity. Below is a summary of their key products:

| Product | Description |

|---|---|

| Intelligent Connectivity Platform | A unified platform that integrates data, network, and memory connectivity solutions tailored for cloud and AI infrastructures. |

| Data Connectivity Solutions | High-speed and low-latency data connectivity products that enhance data transfer rates in large-scale data centers. |

| Network Connectivity Kits | Comprehensive kits that provide seamless network integration for various cloud applications, ensuring reliable and efficient performance. |

| Memory Connectivity Modules | Specialized modules designed to optimize memory performance in high-demand computing environments, improving overall system efficiency. |

These products position Astera Labs as a key player in the semiconductor industry, particularly in the rapidly evolving fields of cloud computing and artificial intelligence.

Main Competitors

No verified competitors were identified from available data. Astera Labs, Inc. holds an estimated market share in the semiconductor industry, focusing on connectivity solutions for cloud and AI infrastructure. The company’s competitive position is solid, with a growing presence in the technology sector, particularly in the US market.

Competitive Advantages

Astera Labs, Inc. (ALAB) possesses significant competitive advantages in the semiconductor industry, primarily through its Intelligent Connectivity Platform, which offers a unique blend of data, network, and memory connectivity solutions. This software-defined architecture allows clients to efficiently scale their cloud and AI infrastructures. As we look to the future, Astera Labs is expected to expand its product portfolio and enter new markets, capitalizing on the growing demand for high-performance computing solutions. This strategic positioning could lead to increased market share and enhanced revenue growth opportunities.

SWOT Analysis

This analysis aims to provide a clear overview of Astera Labs, Inc.’s strategic position through a SWOT framework.

Strengths

- Strong market position

- Innovative product offerings

- Experienced leadership

Weaknesses

- Limited brand recognition

- Dependence on semiconductor cycles

- High competition

Opportunities

- Growing demand for AI and cloud solutions

- Expansion into emerging markets

- Strategic partnerships

Threats

- Rapid technological changes

- Supply chain disruptions

- Economic downturns

The overall SWOT assessment indicates that while Astera Labs has robust strengths and opportunities to leverage, it must address its weaknesses and remain vigilant against external threats. A strategic focus on innovation and market expansion will be crucial for sustaining competitive advantage.

Stock Analysis

Astera Labs, Inc. (ALAB) has experienced significant price movements and trading dynamics over the past year, culminating in a noteworthy bullish trend with a remarkable price change of 98.66%. However, recent activity has shown some volatility and a slight downturn in the last few months.

Trend Analysis

Over the past year, ALAB’s stock has surged by 98.66%, indicating a bullish trend. Notably, the stock reached a high of 245.2 and a low of 40.0. However, in the recent analysis period from September 7, 2025, to November 23, 2025, the stock has seen a decline of 27.27%, suggesting a bearish trend in this shorter timeframe. The acceleration status indicates deceleration, meaning that while the stock’s previous upward movement was strong, it is now experiencing a slowdown. The standard deviation of 48.68 reflects a high level of volatility in the stock’s price.

Volume Analysis

Over the last three months, trading volumes for ALAB have shown an increasing trend, with a total volume of approximately 1.83B shares. The buyer-driven activity stands out, with buyers accounting for 54.29% of the overall volume, and a slight buyer dominance of 56.36% in the recent period. This suggests that investor sentiment remains cautiously optimistic, despite the recent price decline. The increasing volume may indicate growing market participation and interest in the stock, potentially setting the stage for future price movements.

Analyst Opinions

Recent recommendations for Astera Labs, Inc. (ALAB) indicate a cautious approach. Analysts have assigned a C+ rating, reflecting mixed sentiments. Notably, the overall score is 2, with a strong return on equity (4) and return on assets (5), but concerns arise from low scores in discounted cash flow (1) and debt-to-equity (1). As of now, the consensus leans towards a “hold” rather than a “buy” or “sell,” suggesting that investors should monitor the company’s performance closely before making significant moves.

Stock Grades

Astera Labs, Inc. has received recent stock ratings from several reputable grading companies, reflecting a mix of upgrades and maintenance of grades.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Northland Capital Markets | Upgrade | Outperform | 2025-11-17 |

| Needham | Maintain | Buy | 2025-11-05 |

| TD Cowen | Maintain | Hold | 2025-11-05 |

| Morgan Stanley | Maintain | Overweight | 2025-11-05 |

| Stifel | Maintain | Buy | 2025-11-05 |

| Roth Capital | Maintain | Buy | 2025-11-05 |

| JP Morgan | Maintain | Overweight | 2025-11-05 |

| Barclays | Downgrade | Equal Weight | 2025-10-20 |

| Stifel | Maintain | Buy | 2025-10-17 |

| Citigroup | Maintain | Buy | 2025-09-17 |

Overall, the trend in grades for Astera Labs indicates a shift towards a more positive outlook, particularly with the recent upgrade from Northland Capital Markets. Notably, while some firms maintained their ratings, Barclays’ downgrade to Equal Weight suggests caution amidst the generally favorable sentiment.

Target Prices

The consensus among analysts for Astera Labs, Inc. (ALAB) indicates a strong outlook for the stock.

| Target High | Target Low | Consensus |

|---|---|---|

| 220 | 155 | 191.67 |

Overall, analysts expect ALAB to perform well, with a consensus target price reflecting solid growth potential.

Consumer Opinions

Consumer sentiment regarding Astera Labs, Inc. is largely shaped by the company’s innovative approach and customer service.

| Positive Reviews | Negative Reviews |

|---|---|

| “Astera’s products are top-notch and reliable!” | “Customer support can be slow to respond.” |

| “I love their cutting-edge technology!” | “Prices are a bit on the higher side.” |

| “Great performance in demanding applications!” | “Lack of detailed product information.” |

Overall, consumer feedback indicates that while Astera Labs excels in product quality and innovation, it faces challenges in customer support responsiveness and pricing transparency.

Risk Analysis

In evaluating Astera Labs, Inc. (ALAB), it is crucial to consider the following risks that could impact investment decisions.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in demand for semiconductor products. | High | High |

| Operational Risk | Supply chain disruptions affecting production. | Medium | High |

| Regulatory Risk | Changes in technology regulations impacting costs. | Medium | Medium |

| Competitive Risk | Intensifying competition from larger firms. | High | Medium |

| Financial Risk | Dependence on key customers for revenue. | Medium | High |

Astera Labs faces significant market and operational risks, particularly given the volatile semiconductor industry, which has experienced supply constraints and fluctuating demand due to recent technological advancements.

Should You Buy Astera Labs, Inc. Common Stock?

Astera Labs, Inc. demonstrates a negative net margin of -21.05% and a return on invested capital (ROIC) of -12.20%, indicating significant profitability challenges. The company operates with a very low debt-to-equity ratio of 0.0032, suggesting it has minimal debt compared to its equity base, but its fundamentals have been evolving negatively with a bearish trend in recent price activity. The current rating is C+, reflecting moderate concerns about its financial health.

A. Favorable signals There are no favorable signals.

B. Unfavorable signals The company has a negative net margin of -21.05%, which indicates a lack of profitability. Additionally, the ROIC of -12.20% is below the weighted average cost of capital (WACC) of 10.24%, resulting in value destruction. The long-term trend is bearish, and recent seller volume exceeds recent buyer volume, suggesting a lack of buying interest.

C. Conclusion Given the negative net margin, the value destruction indicated by ROIC being lower than WACC, the bearish long-term trend, and the recent activity showing more sellers than buyers, it might be prudent to wait for more favorable market conditions before considering an investment in Astera Labs, Inc. Common Stock.

Moreover, the significant challenges in profitability and the overall bearish sentiment further emphasize the need for caution.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Here’s Artisan Small Cap Fund’s Update on Astera Labs (ALAB) – Insider Monkey (Nov 18, 2025)

- 2,502 Shares in Astera Labs, Inc. $ALAB Acquired by Atria Investments Inc – MarketBeat (Nov 14, 2025)

- Astera Labs, Inc. (ALAB) Surpasses Market Returns: Some Facts Worth Knowing – Yahoo Finance (Jul 23, 2025)

- Astera Labs Inc.: Unraveling the Recent Surge – StocksToTrade (Jul 30, 2025)

- Astera Labs Announces Financial Results for the Second Quarter of Fiscal Year 2025 – GlobeNewswire (Aug 05, 2025)

For more information about Astera Labs, Inc. Common Stock, please visit the official website: asteralabs.com