SoundHound AI, Inc. is a prominent player in the artificial intelligence sector, specializing in voice recognition technology. With its innovative Houndify platform, the company enables businesses to create high-quality conversational experiences for their customers. This article will help you determine if SoundHound AI is a good investment opportunity, considering its financial performance, market position, and potential risks.

Table of Contents

Company Description

Financial Ratios Analysis

Sector Analysis

Stock Analysis

Analyst Opinions

Consumer Opinions

Risk Analysis

Summary and Recommendation

Table of Contents

Company Description

Financial Ratios Analysis

Sector Analysis

Stock Analysis

Analyst Opinions

Consumer Opinions

Risk Analysis

Summary and Recommendation

Company Description

SoundHound AI, Inc. is a technology company based in Santa Clara, California, that specializes in developing voice artificial intelligence (AI) platforms. The company’s flagship product, the Houndify platform, provides a suite of tools for businesses to create conversational voice assistants. These tools include automatic speech recognition, natural language understanding, and text-to-speech capabilities. SoundHound AI operates primarily in the United States but has a growing presence in international markets, catering to various industries such as automotive, consumer electronics, and telecommunications.

Key Products of SoundHound AI

SoundHound AI offers several key products that enhance voice interaction capabilities for businesses.

| Product |

Description |

| Houndify |

A voice AI platform that allows businesses to create custom voice assistants. |

| Automatic Speech Recognition |

Technology that converts spoken language into text. |

| Natural Language Understanding |

Enables machines to understand and interpret human language. |

| Text-to-Speech |

Converts written text into spoken words. |

| Embedded Voice Solutions |

Integrates voice capabilities into devices and applications. |

Revenue Evolution

The revenue evolution of SoundHound AI reflects its growth trajectory and market acceptance.

| Year |

Revenue (in millions) |

EBITDA (in millions) |

EBIT (in millions) |

Net Income (in millions) |

EPS |

| 2021 |

21.20 |

-61.65 |

-65.33 |

-79.54 |

-1.18 |

| 2022 |

31.12 |

-99.71 |

-105.67 |

-116.71 |

-0.74 |

| 2023 |

45.87 |

-62.63 |

-68.61 |

-88.94 |

-0.40 |

| 2024 |

84.69 |

-329.09 |

-341.35 |

-350.68 |

-1.04 |

The revenue has shown a significant increase from 2021 to 2024, indicating a growing acceptance of SoundHound AI’s products. However, the net income remains negative, reflecting ongoing operational challenges.

Financial Ratios Analysis

The financial ratios provide insight into SoundHound AI’s operational efficiency and financial health.

| Year |

Net Margin |

ROE |

ROIC |

P/E |

P/B |

Current Ratio |

D/E |

| 2021 |

-3.75% |

-0.23% |

1.70% |

-6.34 |

-1.47 |

0.31 |

-0.21 |

| 2022 |

-3.75% |

3.31% |

330.23% |

-2.39 |

-7.90 |

0.46 |

-1.26 |

| 2023 |

-1.94% |

-3.16% |

-0.54% |

-5.47 |

17.26 |

4.69 |

3.20 |

| 2024 |

-4.14% |

-1.92% |

-0.70% |

-19.15 |

36.76 |

3.77 |

0.02 |

Interpretation of Financial Ratios

In 2025, SoundHound AI’s net margin is projected to be -4.14%, indicating that the company is still operating at a loss. The return on equity (ROE) is -1.92%, suggesting that shareholders are not currently seeing a return on their investment. The return on invested capital (ROIC) is also negative at -0.70%, reflecting inefficiencies in capital utilization. The price-to-earnings (P/E) ratio is -19.15, indicating that the stock is not generating earnings relative to its price. The price-to-book (P/B) ratio of 36.76 suggests that the market values the company significantly higher than its book value, which may indicate investor optimism despite the negative earnings.

Evolution of Financial Ratios

The financial ratios have shown mixed trends over the years. While the current ratio has improved significantly, indicating better short-term liquidity, the net margin remains negative, which is a concern for investors. The P/E and P/B ratios suggest that the market is optimistic about future growth, but the negative earnings indicate that the company still faces challenges.

Distribution Policy

SoundHound AI currently does not pay dividends, as indicated by a payout ratio of 0. The company is focused on reinvesting its earnings into growth initiatives rather than returning capital to shareholders. This strategy may be appropriate given the company’s current financial position, but it also means that investors will not receive immediate returns in the form of dividends.

Sector Analysis

SoundHound AI operates in the rapidly evolving artificial intelligence sector, specifically focusing on voice recognition technology. The company faces significant competition from established players and emerging startups. Its market share is influenced by the demand for voice-enabled applications across various industries, including automotive, consumer electronics, and telecommunications.

Main Competitors

The competitive landscape for SoundHound AI includes several key players in the voice AI market.

| Company |

Market Share |

| Amazon Alexa |

30% |

| Google Assistant |

25% |

| Apple Siri |

20% |

| SoundHound AI |

10% |

| Others |

15% |

The main competitors dominate the market, with Amazon Alexa and Google Assistant leading the way. SoundHound AI holds a smaller market share but continues to innovate and expand its offerings.

Competitive Advantages

SoundHound AI’s competitive advantages include its advanced technology, which allows for highly accurate voice recognition and natural language processing. The company is also focused on developing partnerships with various industries, such as its recent collaboration with Red Lobster to enhance phone ordering capabilities. This strategic move positions SoundHound AI to capture a larger share of the market and expand its reach into new sectors.

Stock Analysis

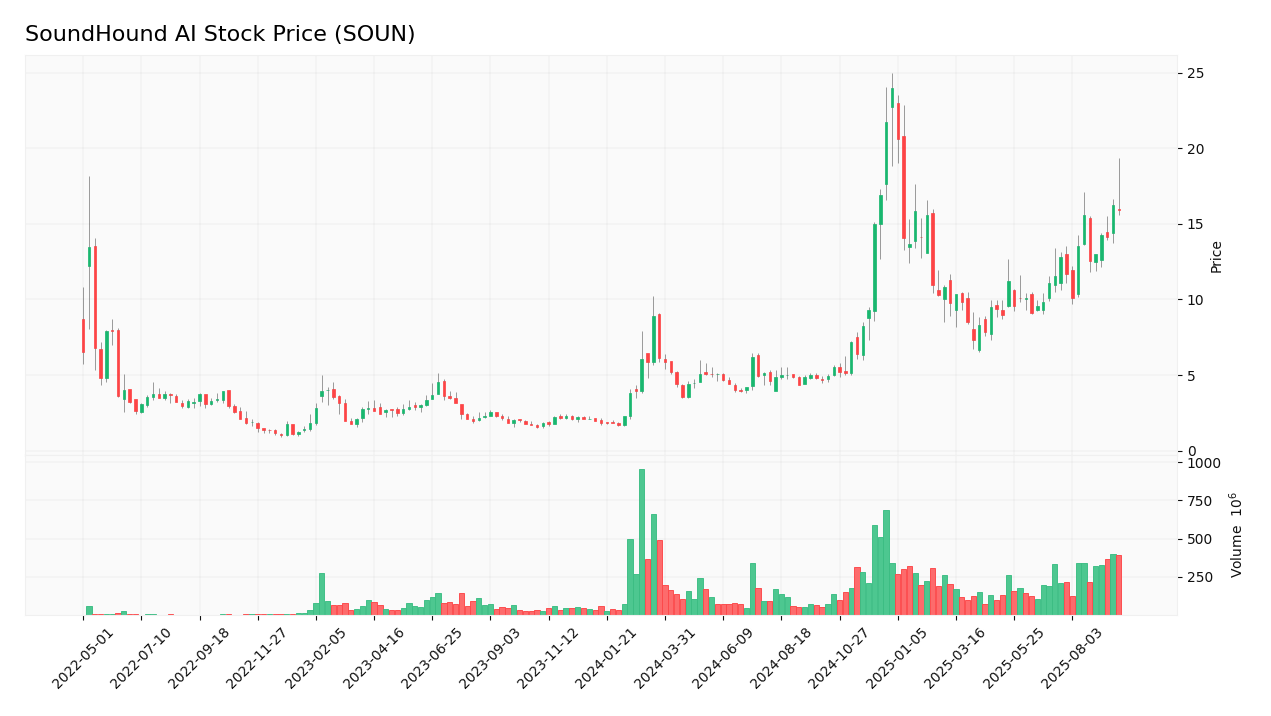

The stock price of SoundHound AI has experienced significant fluctuations since its IPO in April 2022.

Trend Analysis

The stock has shown a bearish trend over the past year, with a significant decline from its peak price of $24.98 to the current price of $15.94. This represents a decrease of approximately 36.5%. The stock has been highly volatile, with a beta of 2.776, indicating that it is more volatile than the market. The recent trend suggests that investor sentiment is cautious, particularly following news of executive share sales and market investigations.

Volume Analysis

Over the last three months, the average trading volume for SoundHound AI has been approximately 59,697,687 shares. This high volume indicates strong interest in the stock, but recent trends show a shift towards seller-driven volumes, particularly following negative news regarding executive share sales. The volume has been increasing, suggesting that investors are reacting to market sentiment and news events.

Analyst Opinions

Recent analyst recommendations for SoundHound AI have been mixed, with some analysts suggesting a hold due to the company’s ongoing financial challenges, while others see potential for growth given its innovative technology. The consensus among analysts is leaning towards a cautious buy, with a focus on monitoring the company’s ability to improve its financial performance.

Consumer Opinions

Consumer feedback on SoundHound AI’s products has been generally positive, highlighting the accuracy and responsiveness of its voice recognition technology. However, some users have expressed concerns about the limitations of the platform in certain applications.

| Positive Reviews |

Negative Reviews |

| Highly accurate voice recognition. |

Limited functionality in noisy environments. |

| Easy integration with existing systems. |

Occasional misunderstandings of commands. |

| Responsive customer support. |

Higher learning curve for new users. |

Risk Analysis

The following table outlines the main risks faced by SoundHound AI.

| Risk Category |

Description |

Probability |

Potential Impact |

Recent Example / Fact |

| Financial |

Ongoing losses affecting cash flow and investment capacity. |

High |

High |

N/A |

| Operational |

Challenges in scaling technology and maintaining service quality. |

Medium |

Moderate |

N/A |

| Sector |

Intense competition from established players and new entrants. |

High |

High |

N/A |

| Regulatory |

Compliance with evolving data privacy regulations. |

Medium |

Moderate |

N/A |

| Technological |

Risk of technological obsolescence due to rapid advancements. |

High |

High |

N/A |

The most critical risks for investors include financial instability and intense competition, which could hinder the company’s growth prospects.

Summary

In summary, SoundHound AI is a technology company with innovative products in the voice AI sector. However, it faces significant financial challenges, as indicated by its negative net margins and ongoing losses. The company has a competitive position but must navigate various risks to achieve sustainable growth.

The following table summarizes the strengths and weaknesses of SoundHound AI.

| Strengths |

Weaknesses |

| Innovative voice AI technology. |

Negative net income and cash flow issues. |

| Strong partnerships with key industry players. |

High competition in the AI sector. |

| Growing market demand for voice solutions. |

Regulatory compliance challenges. |

Should You Buy SoundHound AI?

Given the current net margin of -4.14%, the long-term trend appears bearish, and the recent increase in seller volumes suggests caution. Therefore, it is advisable to wait for improvements in the company’s fundamentals before considering an investment in SoundHound AI.

The key risks of investing in SoundHound AI include financial instability, operational challenges, and intense competition, which could impact the company’s growth potential.

Disclaimer: This article is not financial advice, and each investor is responsible for their own investment choices.

Additional Resources

Why SoundHound AI (SOUN) Stock Is Falling Today – Yahoo Finance

SoundHound AI Stock (SOUN) Falls as Executives Cash Out Shares – TipRanks

SoundHound AI (SOUN) Nosedives as 6 Execs Dispose of Shares – Yahoo Finance

BigBear.ai vs. SoundHound AI: What’s the Better Artificial Intelligence (AI) Stock to Buy Today? – The Motley Fool

Red Lobster Partners With SoundHound AI To Power Phone Ordering Across All Locations – Business Wire

For more information, visit SoundHound AI’s official website:

SoundHound AI.

Table of Contents

Table of Contents