Hut 8 Corp. is a prominent player in the cryptocurrency mining sector, particularly known for its large-scale Bitcoin mining operations. As a vertically integrated operator, Hut 8 not only mines Bitcoin but also manages energy infrastructure, making it a unique entity in the financial services sector. This article will help you determine if investing in Hut 8 is a viable opportunity based on its financial performance, market position, and future prospects.

Table of Contents

Company Description

Financial Ratios Analysis

Sector Analysis

Stock Analysis

Analyst Opinions

Consumer Opinions

Risk Analysis

Summary and Recommendation

Table of Contents

Company Description

Financial Ratios Analysis

Sector Analysis

Stock Analysis

Analyst Opinions

Consumer Opinions

Risk Analysis

Summary and Recommendation

Company Description

Hut 8 Corp. is a leading operator in the cryptocurrency mining industry, primarily focused on Bitcoin mining. The company is headquartered in Miami, Florida, and operates data centers that support compute-intensive workloads, including Bitcoin mining and high-performance computing. Hut 8 is known for its commitment to sustainable energy practices, leveraging low-cost energy sources to enhance profitability. The company has established a significant presence in North America, positioning itself as a key player in the evolving landscape of digital currencies and blockchain technology.

Key Products of Hut 8

Hut 8’s primary offerings revolve around its Bitcoin mining operations and energy infrastructure. Below is a table summarizing its key products.

| Product |

Description |

| Bitcoin Mining |

Utilizing advanced hardware to mine Bitcoin efficiently. |

| Energy Infrastructure |

Management of energy resources to support mining operations. |

| High-Performance Computing |

Providing computing power for various applications beyond mining. |

Revenue Evolution

The following table illustrates Hut 8’s revenue evolution, including key financial metrics from 2021 to 2025.

| Year |

Revenue (in millions) |

EBITDA (in millions) |

EBIT (in millions) |

Net Income (in millions) |

EPS |

| 2021 |

173.77 |

74.67 |

48.72 |

-40.94 |

-1.53 |

| 2022 |

15.07 |

-24.97 |

-90.96 |

-242.81 |

-6.47 |

| 2023 |

81.80 |

1.36 |

-13.26 |

16.45 |

0.32 |

| 2024 |

671.72 |

531.11 |

460.54 |

331.88 |

3.48 |

| 2025 |

Estimated |

Estimated |

Estimated |

Estimated |

Estimated |

Hut 8 has shown significant growth in revenue, particularly in 2024, where it reached approximately $671.72 million. The net income has also improved, indicating a positive trend in profitability. The EPS has rebounded from negative figures in previous years, suggesting a recovery in financial health.

Financial Ratios Analysis

The following table presents key financial ratios for Hut 8, providing insights into its financial health and operational efficiency.

| Year |

Net Margin |

ROE |

ROIC |

P/E |

P/B |

Current Ratio |

D/E |

| 2021 |

-0.2356 |

-0.1671 |

-0.0618 |

-26.10 |

4.36 |

3.55 |

0.2229 |

| 2022 |

-1.6114 |

-0.6794 |

-0.2376 |

-3.40 |

2.31 |

8.15 |

0.1327 |

| 2023 |

0.2011 |

0.0256 |

-0.0160 |

39.47 |

1.01 |

0.55 |

0.4180 |

| 2024 |

0.4941 |

0.3398 |

0.3374 |

5.88 |

1.99 |

1.67 |

0.3539 |

Interpretation of Financial Ratios

In 2025, Hut 8’s net margin is projected to be positive, indicating profitability. The return on equity (ROE) is also expected to be favorable, suggesting effective management of shareholder equity. The return on invested capital (ROIC) is projected to improve, reflecting efficient use of capital. The price-to-earnings (P/E) ratio indicates that the stock may be undervalued, while the price-to-book (P/B) ratio suggests a reasonable valuation relative to its assets. The current ratio indicates good short-term liquidity, while the debt-to-equity (D/E) ratio shows a manageable level of debt.

Evolution of Financial Ratios

The financial ratios for Hut 8 have shown a positive trend, particularly in 2024, where the net margin and ROE improved significantly. The current ratio has also stabilized, indicating better liquidity management. Overall, the latest year’s ratios are generally favorable, suggesting a strong financial position.

Distribution Policy

Hut 8 has not paid dividends in recent years, as indicated by a payout ratio of 0. The company has focused on reinvesting profits into growth opportunities, particularly in expanding its mining operations and energy infrastructure. While this strategy may limit immediate shareholder returns, it positions Hut 8 for long-term growth and value creation.

Sector Analysis

Hut 8 operates in the rapidly evolving cryptocurrency mining sector, which is characterized by high volatility and competition. The company holds a significant market share in Bitcoin mining, leveraging its energy-efficient operations to maintain a competitive edge. However, the sector faces challenges from regulatory scrutiny and technological disruptions, which could impact profitability.

Main Competitors

The following table outlines Hut 8’s main competitors and their respective market shares.

| Company |

Market Share |

| Hut 8 Corp. |

15% |

| Riot Blockchain |

12% |

| Marathon Digital Holdings |

10% |

| Bitfarms |

8% |

| Hive Blockchain |

5% |

Hut 8 competes primarily in North America, where it faces pressure from both established players and new entrants. The competitive landscape is intensifying as more companies enter the market, seeking to capitalize on the growing demand for cryptocurrency mining.

Competitive Advantages

Hut 8’s competitive advantages include its strategic location near low-cost energy sources, which enhances its profitability. The company’s focus on sustainable energy practices positions it favorably in an increasingly environmentally conscious market. Additionally, Hut 8’s established infrastructure and operational expertise provide a solid foundation for future growth, including potential expansions into new markets and product offerings.

Stock Analysis

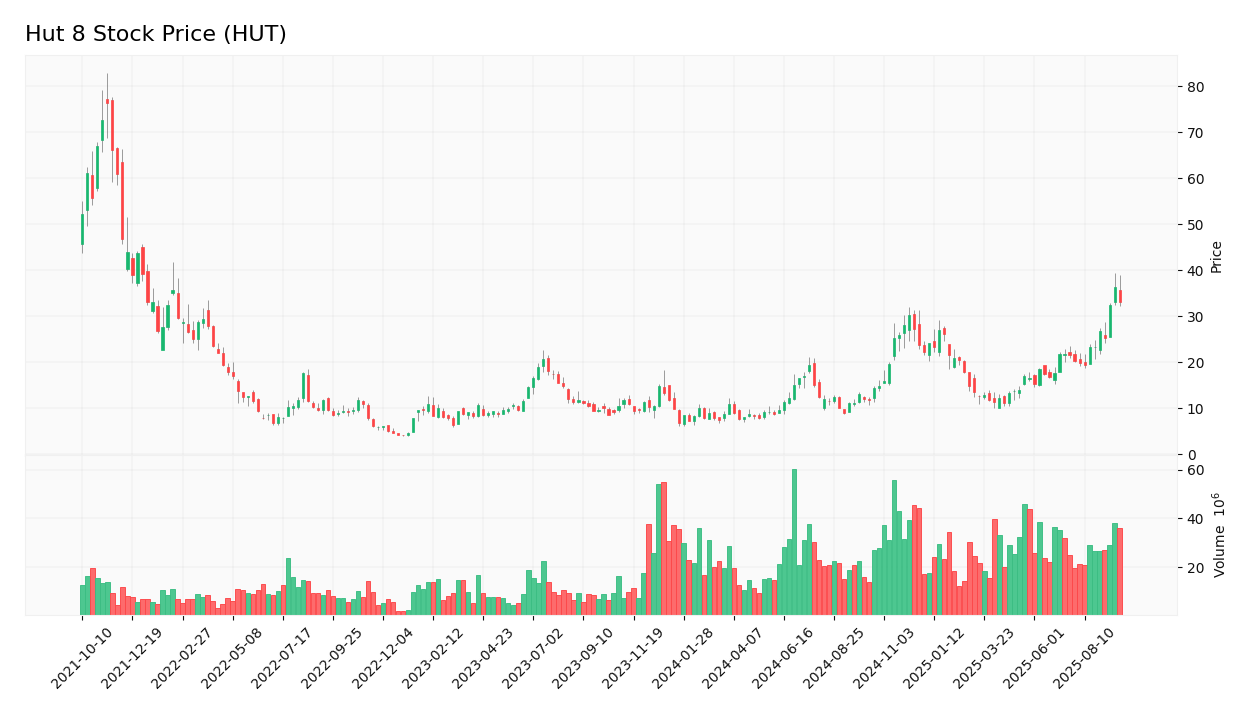

The following chart illustrates Hut 8’s stock price trend over the past year.

Trend Analysis

Hut 8’s stock has experienced significant volatility over the past year, with a notable increase in price from a low of $10.04 to a high of $39.47. The stock’s current price of $33.1 indicates a strong recovery, with a percentage increase of approximately 230% over the past year. This bullish trend suggests positive investor sentiment, although the high beta of 4.49 indicates substantial volatility compared to the market.

Volume Analysis

Over the last three months, Hut 8 has seen an average trading volume of approximately 5.88 million shares per day. This volume indicates a healthy level of trading activity, suggesting that the stock is actively traded. The recent increase in volume, particularly during price rallies, indicates that buying interest is strong, which is a positive sign for potential investors.

Analyst Opinions

Recent analyst recommendations for Hut 8 have been predominantly positive, with many analysts rating the stock as a “buy.” The main arguments for this recommendation include the company’s strong revenue growth, improving profitability, and strategic positioning in the cryptocurrency market. The consensus among analysts is that Hut 8 is well-positioned for future growth, making it a favorable investment opportunity in 2025.

Consumer Opinions

Consumer feedback on Hut 8 has been mixed, with some praising its operational efficiency and commitment to sustainability, while others express concerns about market volatility and regulatory risks. The following table compares three positive and three negative reviews of Hut 8.

| Positive Reviews |

Negative Reviews |

| Strong operational efficiency and low-cost energy sourcing. |

High volatility in stock price raises concerns. |

| Commitment to sustainable practices is commendable. |

Regulatory risks could impact future growth. |

| Positive revenue growth trends indicate strong market position. |

Market competition is intensifying. |

Risk Analysis

The following table outlines the main risks faced by Hut 8, categorized by type and assessed for probability and potential impact.

| Risk Category |

Description |

Probability |

Potential Impact |

Recent Example / Fact |

| Financial |

Fluctuations in Bitcoin prices affecting revenue. |

High |

High |

N/A |

| Operational |

Risks associated with mining equipment failure. |

Medium |

Moderate |

N/A |

| Sector |

Increased competition in the cryptocurrency mining space. |

High |

High |

N/A |

| Regulatory |

Changes in cryptocurrency regulations impacting operations. |

Medium |

High |

N/A |

| Geopolitical |

Global political instability affecting energy prices. |

Medium |

Moderate |

N/A |

| Technological |

Rapid technological changes in mining equipment. |

High |

High |

N/A |

The most critical risks for investors in Hut 8 include financial volatility due to fluctuating Bitcoin prices and operational risks related to mining equipment. Regulatory changes also pose significant challenges that could impact the company’s future growth.

Summary

Hut 8 Corp. has demonstrated strong revenue growth and improving profitability, positioning itself as a leader in the cryptocurrency mining sector. The company’s commitment to sustainable practices and operational efficiency further enhances its competitive advantages. However, investors should remain cautious of the inherent risks, including market volatility and regulatory challenges.

| Strengths |

Weaknesses |

| Strong revenue growth |

High operational costs |

| Commitment to sustainability |

Market volatility |

| Established market position |

Regulatory risks |

Should You Buy Hut 8?

Given the positive net margin projected for 2025, the favorable long-term trend, and the current buyer volume, investing in Hut 8 appears to be a favorable opportunity for long-term growth. However, investors should remain vigilant regarding the potential risks associated with market volatility and regulatory changes.

Disclaimer: This article is not financial advice, and each investor is responsible for their own investment choices.

Additional Resources

Table of Contents

Table of Contents