In a world increasingly driven by technology, NXP Semiconductors N.V. stands as a pivotal force in shaping the semiconductor landscape. Their innovative microcontrollers and cutting-edge wireless solutions are integral to automotive, industrial, and IoT applications, making daily interactions more seamless and efficient. With a reputation for quality and a commitment to innovation, NXP consistently drives market trends. As I delve into the investment potential of NXP, I’ll explore whether its robust fundamentals continue to justify its current market valuation and growth trajectory.

Table of contents

Company Description

NXP Semiconductors N.V. is a prominent player in the semiconductor industry, incorporated in 2006 and headquartered in Eindhoven, the Netherlands. The company specializes in a diverse range of semiconductor products, including microcontrollers, application processors, and wireless connectivity solutions. NXP serves various sectors such as automotive, industrial, and the Internet of Things (IoT), positioning itself as a leader in providing innovative solutions to original equipment manufacturers and contract manufacturers worldwide. With operations in key markets including China, the U.S., and Germany, NXP’s strategic focus on cutting-edge technologies and robust ecosystem partnerships underscores its pivotal role in shaping the future of connected devices and smart applications.

Fundamental Analysis

In this section, I will analyze NXP Semiconductors N.V.’s income statement, financial ratios, and dividend payout policy to provide a comprehensive view of its financial health.

Income Statement

Below is the income statement for NXP Semiconductors N.V. (NXPI) over the past five fiscal years, providing insights into the company’s financial performance.

| Year | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 8.61B | 11.06B | 13.21B | 13.28B | 12.61B |

| Cost of Revenue | 4.38B | 4.99B | 5.69B | 5.73B | 5.50B |

| Operating Expenses | 3.82B | 3.48B | 3.72B | 3.89B | 3.70B |

| Gross Profit | 4.24B | 6.07B | 7.52B | 7.55B | 7.12B |

| EBITDA | 2.35B | 3.81B | 5.04B | 4.90B | 4.42B |

| EBIT | 0.36B | 2.55B | 3.80B | 3.79B | 3.50B |

| Interest Expense | 0.36B | 0.37B | 0.43B | 0.44B | 0.40B |

| Net Income | 0.05B | 0.19B | 0.28B | 0.28B | 2.51B |

| EPS | 0.19 | 6.91 | 10.64 | 10.83 | 9.84 |

| Filing Date | 2021-02-25 | 2022-02-24 | 2023-03-01 | 2024-02-22 | 2025-02-20 |

Interpretation of Income Statement

Over the five-year period, NXP Semiconductors has shown fluctuations in revenue, peaking in 2023 at 13.28B before declining to 12.61B in 2024. Notably, net income surged to 2.51B in 2024 following a period of stability, indicating improved operational efficiency despite lower revenue. Gross and operating margins remained relatively stable, with slight improvements in 2024. The recent year’s performance suggests that while revenue growth has slowed, effective cost management has led to significant net income growth, showcasing resilience amid market challenges.

Financial Ratios

Below is the financial ratios table for NXP Semiconductors N.V. (NXPI) over recent fiscal years:

| Metrics | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 0.6038% | 16.91% | 21.11% | 21.07% | 19.90% |

| ROE | 0.5814% | 28.66% | 37.41% | 32.36% | 27.33% |

| ROIC | -62.52% | 12.28% | 16.03% | 14.54% | 12.91% |

| P/E | 855.48 | 32.95 | 14.85 | 21.22 | 21.13 |

| P/B | 4.97 | 9.45 | 5.56 | 6.87 | 5.78 |

| Current Ratio | 2.14 | 2.13 | 2.12 | 1.91 | 2.36 |

| Quick Ratio | 1.63 | 1.65 | 1.58 | 1.39 | 1.60 |

| D/E | 0.8507 | 1.6195 | 1.4989 | 1.2928 | 1.1819 |

| Debt-to-Assets | 38.34% | 50.67% | 48.05% | 45.89% | 44.51% |

| Interest Coverage | 1.15 | 7.00 | 8.89 | 8.36 | 8.59 |

| Asset Turnover | 0.4339 | 0.5302 | 0.5683 | 0.5451 | 0.5173 |

| Fixed Asset Turnover | 3.77 | 4.20 | 4.25 | 3.99 | 3.86 |

| Dividend Yield | 0.9441 | 0.9115 | 1.9693 | 1.6952 | 1.9568 |

Interpretation of Financial Ratios

Analyzing NXP Semiconductors N.V. (NXPI) based on the 2024 financial ratios reveals a mixed picture of financial health. The current ratio of 2.36 indicates strong liquidity, while a quick ratio of 1.60 suggests that the company can cover its short-term liabilities efficiently. However, the solvency ratio stands at 0.23, implying potential concerns regarding long-term financial stability. Profitability ratios exhibit strength, with a net profit margin of 19.90% and an EBITDA margin of 34.37%. While these are healthy figures, the debt-to-equity ratio of 1.18 raises questions about leverage risks. Overall, NXPI displays solid profitability and liquidity but warrants caution due to its solvency metrics and leverage.

Evolution of Financial Ratios

Over the past five years, NXPI’s financial ratios have generally improved, particularly in profitability, where net profit margins have increased from 6.04% in 2020 to 19.90% in 2024. However, the solvency ratio has fluctuated, highlighting ongoing concerns about long-term financial health.

Distribution Policy

NXP Semiconductors N.V. currently pays dividends, with a payout ratio of 41.4% and an annual dividend yield of approximately 1.96%. The dividend per share has shown a consistent upward trend, reflecting the company’s commitment to returning value to shareholders. Additionally, NXP engages in share buyback programs, which can enhance shareholder value but may pose risks if the repurchases are excessive. Overall, the distribution strategy supports sustainable long-term value creation for shareholders.

Sector Analysis

NXP Semiconductors N.V. is a key player in the semiconductor industry, specializing in microcontrollers and wireless connectivity solutions, competing with major firms like Qualcomm and Texas Instruments. Its strengths lie in innovation and diverse applications across automotive and IoT sectors.

Strategic Positioning

NXP Semiconductors N.V. (NXPI) holds a competitive position in the semiconductor market, with a market capitalization of approximately $48.2B. Their key product lines, particularly in automotive and IoT solutions, capture significant market share amidst rising demand for advanced technology. However, competitive pressures from rivals in the semiconductor industry and ongoing technological disruptions necessitate continual innovation and efficiency. NXP’s diversified product offerings, including microcontrollers and wireless connectivity solutions, help mitigate risks associated with market fluctuations and enhance its resilience against competitive threats.

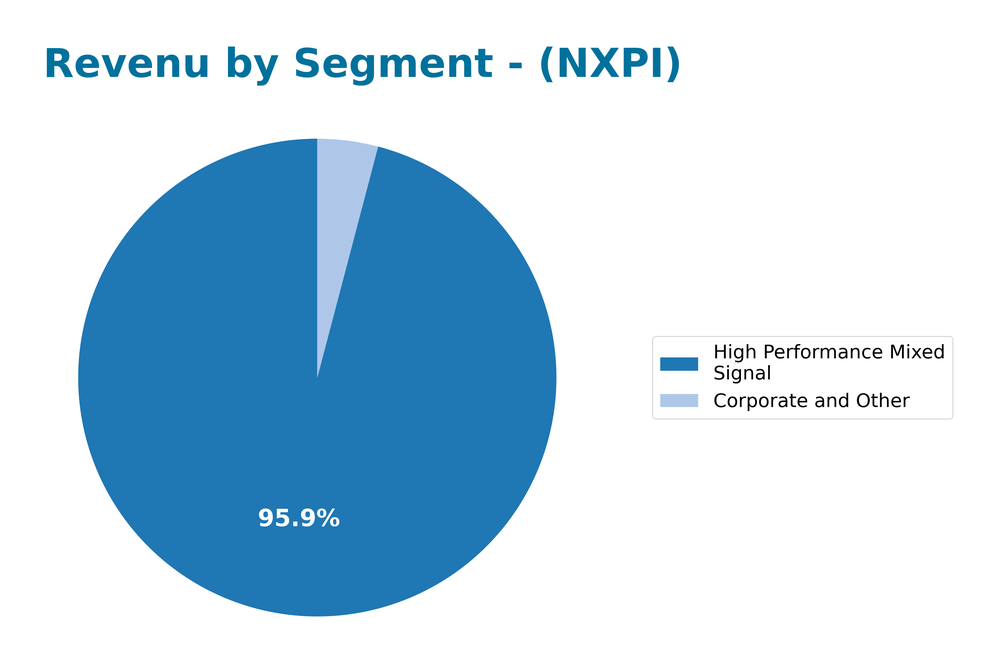

Revenue by Segment

The following chart illustrates the revenue distribution by segment for NXP Semiconductors N.V. during the fiscal year 2018.

In 2018, NXP’s revenue was primarily driven by the High Performance Mixed Signal segment, which generated $9B. The Corporate and Other segment contributed $385M, while the Standard Products segment remained negligible with no reported revenue. Compared to previous years, the High Performance Mixed Signal segment has shown consistent growth, indicating its crucial role in NXP’s portfolio. However, the lack of revenue from Standard Products may hint at potential concentration risks, warranting further investigation into diversification strategies for sustainable growth.

Key Products

NXP Semiconductors N.V. offers a diverse range of semiconductor products that cater to various industries. Below is a table summarizing some of their key products:

| Product | Description |

|---|---|

| Microcontrollers | Integrated circuits that control other devices and processes, vital for automotive and industrial applications. |

| i.MX Application Processors | High-performance processors designed for multimedia and connectivity applications, particularly in smart devices. |

| Wireless Connectivity Solutions | Technologies including Bluetooth, Wi-Fi, and NFC, enabling communication in IoT and mobile applications. |

| Analog and Interface Devices | Components that facilitate signal processing and connectivity in electronic systems. |

| Security Controllers | Hardware-based security solutions ensuring data protection in various applications, including automotive and IoT. |

| Environmental Sensors | Semiconductor-based sensors that measure pressure, motion, and environmental conditions for smart applications. |

| Radio Frequency Power Amplifiers | Devices that amplify radio signals for communication systems, enhancing signal strength in various applications. |

With a solid portfolio, NXP Semiconductors positions itself strongly within the semiconductor industry, serving a range of sectors including automotive, industrial, and communication infrastructure.

Main Competitors

No verified competitors were identified from available data. However, NXP Semiconductors N.V. holds a significant position in the semiconductor industry, with a market capitalization of approximately $48.2B. The company operates in a competitive landscape focused on automotive, industrial, and Internet of Things applications, showcasing its strength in various sectors.

Competitive Advantages

NXP Semiconductors N.V. (NXPI) possesses significant competitive advantages, primarily through its diverse and innovative product portfolio, which includes microcontrollers and wireless connectivity solutions. The company’s strong foothold in key markets such as automotive and IoT underscores its relevance in a rapidly evolving technological landscape. Looking ahead, NXP is poised to capitalize on emerging opportunities, particularly in electric vehicles and smart infrastructure, as it continues to develop next-generation semiconductor solutions. This strategic positioning enhances its potential for sustained growth and profitability in the coming years.

SWOT Analysis

This analysis aims to provide a clear understanding of NXP Semiconductors N.V.’s position in the market through its strengths, weaknesses, opportunities, and threats.

Strengths

- Strong market position

- Diverse product portfolio

- Global presence

Weaknesses

- High dependency on automotive sector

- Competitive industry landscape

- Regulatory challenges

Opportunities

- Expansion in IoT market

- Growth in electric vehicle sector

- Strategic partnerships

Threats

- Supply chain disruptions

- Rapid technological changes

- Economic downturns

Overall, NXP Semiconductors N.V. demonstrates solid strengths and opportunities that can be leveraged for growth, particularly in the expanding IoT and electric vehicle markets. However, it must address its weaknesses and remain vigilant against external threats to maintain its competitive edge and ensure sustainable growth.

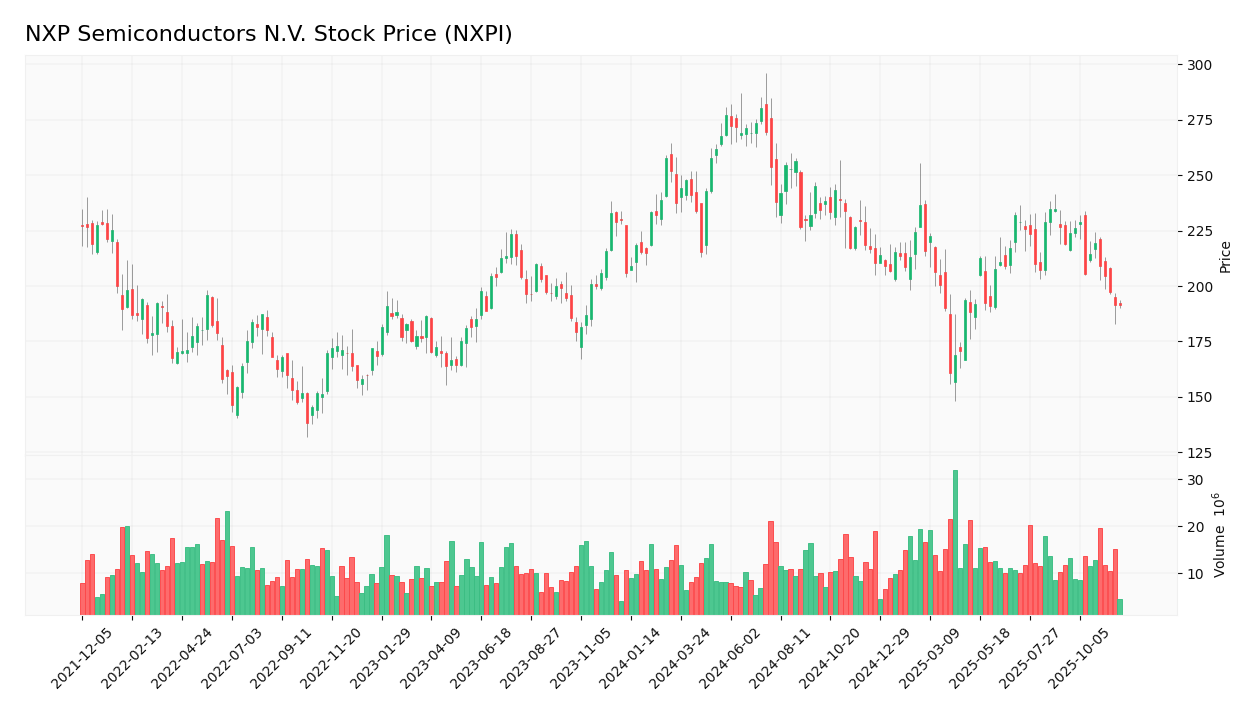

Stock Analysis

Over the past year, NXP Semiconductors N.V. (ticker: NXPI) has experienced notable price movements, reflecting a challenging trading environment characterized by a bearish trend and significant volatility.

Trend Analysis

Analyzing the stock’s performance over the past year, NXPI has seen a percentage change of -6.88%. This indicates a bearish trend, as the decline exceeds the -2% threshold. The stock has experienced notable highs at 280.19 and lows at 160.81, with the trend currently showing signs of deceleration. The standard deviation of 24.65 suggests considerable volatility during this period.

Volume Analysis

In the last three months, the trading volume for NXPI has been 1.42B, with a slight seller dominance reflected in the buyer volume of 671M compared to seller volume of 740M. Volume activity appears to be increasing, indicating heightened market participation. However, the buyer percentage stands at 47.24%, suggesting that investor sentiment leans slightly toward selling, which could reflect caution among traders given the bearish trend.

Analyst Opinions

Recent analyst recommendations for NXP Semiconductors N.V. (NXPI) show a consensus rating of “Buy.” Analysts favoring this position cite strong fundamentals, particularly in discounted cash flow and return on equity, which both received scores of 4. Notably, analysts indicate confidence in the company’s ability to generate sustainable growth despite a lower debt-to-equity score of 1. With an overall score of 3, the sentiment remains optimistic as NXP continues to thrive in a competitive market.

Stock Grades

NXP Semiconductors N.V. (NXPI) has received various stock grades from reputable grading companies. Below is a summary of the latest ratings:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Neutral | 2025-10-29 |

| Truist Securities | Maintain | Buy | 2025-10-29 |

| JP Morgan | Maintain | Neutral | 2025-07-23 |

| Wells Fargo | Maintain | Overweight | 2025-07-23 |

| Truist Securities | Maintain | Buy | 2025-07-23 |

| Susquehanna | Maintain | Neutral | 2025-07-23 |

| Barclays | Maintain | Overweight | 2025-07-22 |

| Needham | Maintain | Buy | 2025-07-22 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-07-22 |

| Stifel | Maintain | Hold | 2025-07-18 |

Overall, the trend in grades for NXPI indicates a stable outlook, with several firms maintaining their ratings across neutral, overweight, and buy categories. Notably, the consistent “Buy” ratings from Truist Securities and Needham suggest a positive sentiment among some analysts.

Target Prices

The current consensus for NXP Semiconductors N.V. (NXPI) indicates a range of target prices set by analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 280 | 215 | 247.75 |

Analysts expect NXPI’s stock to reach a consensus of approximately 247.75, reflecting a positive outlook within the provided range.

Consumer Opinions

Consumer sentiment regarding NXP Semiconductors N.V. (NXPI) reveals a mixed yet informative perspective on the company’s products and services.

| Positive Reviews | Negative Reviews |

|---|---|

| “Excellent performance in automotive chips.” | “Customer service response times need improvement.” |

| “Innovative solutions for IoT applications.” | “Pricing can be higher compared to competitors.” |

| “Reliable products with great longevity.” | “Occasional supply chain issues reported.” |

Overall, consumer feedback indicates strong satisfaction with NXP’s innovative products, particularly in automotive and IoT sectors. However, concerns about customer service and pricing consistency are recurring themes that the company may need to address.

Risk Analysis

In this section, I present a concise overview of potential risks associated with investing in NXP Semiconductors N.V. (NXPI).

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in semiconductor demand and pricing. | High | High |

| Regulatory Risk | Changes in trade policies affecting supply chains. | Medium | High |

| Technological Risk | Rapid advancements may outpace company innovation. | Medium | Medium |

| Operational Risk | Disruptions in manufacturing processes. | Low | High |

| Competition Risk | Increased competition from emerging tech firms. | High | Medium |

Investors should be particularly cautious of market and regulatory risks, as the semiconductor industry is highly sensitive to global economic shifts and governmental policies.

Should You Buy NXP Semiconductors N.V.?

NXP Semiconductors exhibits a positive net margin of 19.90% and a return on invested capital (ROIC) of 12.91%, indicating strong profitability. However, with a total debt of 10.85B and a debt-to-equity ratio of 0.22, the company maintains a relatively high level of debt. Over the recent years, the fundamentals have shown mixed results, with fluctuations in revenue and net income. The company currently holds a rating of B.

Favorable signals The company has a positive net margin of 19.90% and a return on invested capital (ROIC) of 12.91%, which exceeds its weighted average cost of capital (WACC) of 9.06%. This demonstrates effective capital utilization and value creation.

Unfavorable signals The overall stock trend is bearish, with a price change percentage of -6.88% over the recent period. The recent seller volume of 82.38M exceeds the buyer volume of 59.68M, indicating a seller-dominant market.

Conclusion Given the positive net margin and value creation, one might observe favorable conditions for investment; however, the bearish trend and recent seller dominance suggest it may be prudent to wait for more positive market signals before making a decision.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Those who invested in NXP Semiconductors (NASDAQ:NXPI) five years ago are up 31% – Yahoo Finance (Nov 22, 2025)

- NXP Semiconductors (NASDAQ:NXPI) Will Pay A Dividend Of $1.01 – simplywall.st (Nov 23, 2025)

- Legal & General Group Plc Grows Stake in NXP Semiconductors N.V. $NXPI – MarketBeat (Nov 23, 2025)

- NXP Semiconductors (NASDAQ: NXPI) announces $1.014 interim dividend for Q4 – Stock Titan (Nov 19, 2025)

- NXP Semiconductors N.V. $NXPI Shares Purchased by DNB Asset Management AS – MarketBeat (Nov 24, 2025)

For more information about NXP Semiconductors N.V., please visit the official website: nxp.com