Microsoft Corporation, a global leader in technology, has consistently demonstrated its ability to innovate and adapt in a rapidly changing market. With a diverse portfolio that includes software, cloud services, and hardware, Microsoft remains a formidable player in the tech industry. This article will help you determine if investing in Microsoft is a sound opportunity based on its financial performance, market position, and future prospects.

Table of Contents

Company Description

Financial Ratios Analysis

Sector Analysis

Stock Analysis

Analyst Opinions

Consumer Opinions

Risk Analysis

Summary and Recommendation

Table of Contents

Company Description

Financial Ratios Analysis

Sector Analysis

Stock Analysis

Analyst Opinions

Consumer Opinions

Risk Analysis

Summary and Recommendation

Company Description

Microsoft Corporation develops, licenses, and supports software, services, devices, and solutions worldwide. The company operates in three segments: Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. Its flagship products include the Windows operating system, Office productivity suite, and Azure cloud services. Microsoft has a strong presence in North America, Europe, and Asia, catering to both individual consumers and large enterprises. The company was founded in 1975 and is headquartered in Redmond, Washington.

Key Products of Microsoft

Microsoft offers a wide range of products and services that cater to various market needs. Below is a table summarizing some of its key products.

| Product |

Description |

| Windows |

Operating system for personal computers and servers. |

| Office 365 |

Cloud-based productivity suite including Word, Excel, and PowerPoint. |

| Azure |

Cloud computing platform offering a range of services including analytics, storage, and networking. |

| Dynamics 365 |

Enterprise resource planning and customer relationship management software. |

| Xbox |

Gaming console and online gaming services. |

Revenue Evolution

Microsoft has shown impressive revenue growth over the past few years. Below is a table showing the evolution of key financial metrics from 2021 to 2025.

| Year |

Revenue (in millions) |

EBITDA (in millions) |

EBIT (in millions) |

Net Income (in millions) |

EPS |

| 2021 |

168088 |

85134 |

69916 |

61271 |

8.12 |

| 2022 |

198270 |

100239 |

83383 |

72738 |

9.70 |

| 2023 |

211915 |

105140 |

88523 |

72361 |

9.72 |

| 2024 |

245122 |

133009 |

109433 |

88136 |

11.86 |

| 2025 |

281724 |

160165 |

128528 |

101832 |

13.70 |

Microsoft’s revenue has increased significantly, with a notable rise in net income and EPS, indicating strong financial health and operational efficiency.

Financial Ratios Analysis

The financial ratios provide insight into Microsoft’s operational efficiency, profitability, and liquidity. Below is a table summarizing key financial ratios from 2021 to 2025.

| Year |

Net Margin |

ROE |

ROIC |

P/E |

P/B |

Current Ratio |

D/E |

| 2021 |

0.3645 |

0.4315 |

0.2852 |

33.37 |

14.40 |

2.08 |

0.48 |

| 2022 |

0.3669 |

0.4368 |

0.3091 |

26.47 |

11.56 |

1.78 |

0.37 |

| 2023 |

0.3415 |

0.3509 |

0.2876 |

35.04 |

12.30 |

1.77 |

0.29 |

| 2024 |

0.3596 |

0.3283 |

0.2829 |

38.51 |

12.64 |

1.27 |

0.25 |

| 2025 |

0.3615 |

0.2965 |

0.2690 |

36.31 |

10.76 |

1.35 |

0.18 |

Interpretation of Financial Ratios

In 2025, Microsoft’s net margin of 36.15% indicates strong profitability, while a return on equity (ROE) of 29.65% reflects effective management of shareholder equity. The return on invested capital (ROIC) of 26.90% suggests that the company is generating substantial returns on its investments. The price-to-earnings (P/E) ratio of 36.31 indicates that investors are willing to pay a premium for the stock, reflecting confidence in future growth. The price-to-book (P/B) ratio of 10.76 suggests that the stock is trading at a significant premium to its book value, which may indicate overvaluation.

Evolution of Financial Ratios

The financial ratios have shown a generally favorable trend over the years, with net margin and ROE remaining strong. The current ratio has decreased slightly, indicating a potential tightening of liquidity, but remains above 1, suggesting that Microsoft can cover its short-term liabilities. Overall, the latest year’s ratios are favorable, indicating a solid financial position.

Distribution Policy

Microsoft has a consistent distribution policy, with a payout ratio of approximately 23.65% in 2025, indicating that it returns a portion of its earnings to shareholders through dividends. The annual dividend yield is around 0.65%, which, while modest, reflects the company’s commitment to returning value to shareholders. Additionally, Microsoft has engaged in share buybacks, which can enhance shareholder value by reducing the number of outstanding shares. However, the company must ensure that its dividends are covered by cash flow to maintain financial stability.

Sector Analysis

Microsoft operates in the highly competitive technology sector, particularly in software and cloud computing. The company holds a significant market share in various product categories, including operating systems and productivity software. However, it faces competitive pressure from other tech giants, particularly in the cloud computing space, where companies like Amazon and Google are also strong players. Technological disruption is a constant threat, as new innovations can quickly change the landscape.

Main Competitors

The following table summarizes Microsoft’s main competitors and their respective market shares.

| Company |

Market Share |

| Microsoft |

30% |

| Apple |

25% |

| Google |

20% |

| Amazon |

15% |

| IBM |

10% |

Microsoft’s main competitors include Apple, Google, Amazon, and IBM, with varying market shares across different product categories. The competition is particularly fierce in the cloud computing and productivity software markets, where innovation and customer service are critical.

Competitive Advantages

Microsoft’s competitive advantages include its strong brand recognition, extensive product ecosystem, and significant investment in research and development. The company is well-positioned to capitalize on emerging technologies, such as artificial intelligence and cloud computing, which are expected to drive future growth. Additionally, Microsoft’s established customer base and partnerships provide a solid foundation for expanding into new markets.

Stock Analysis

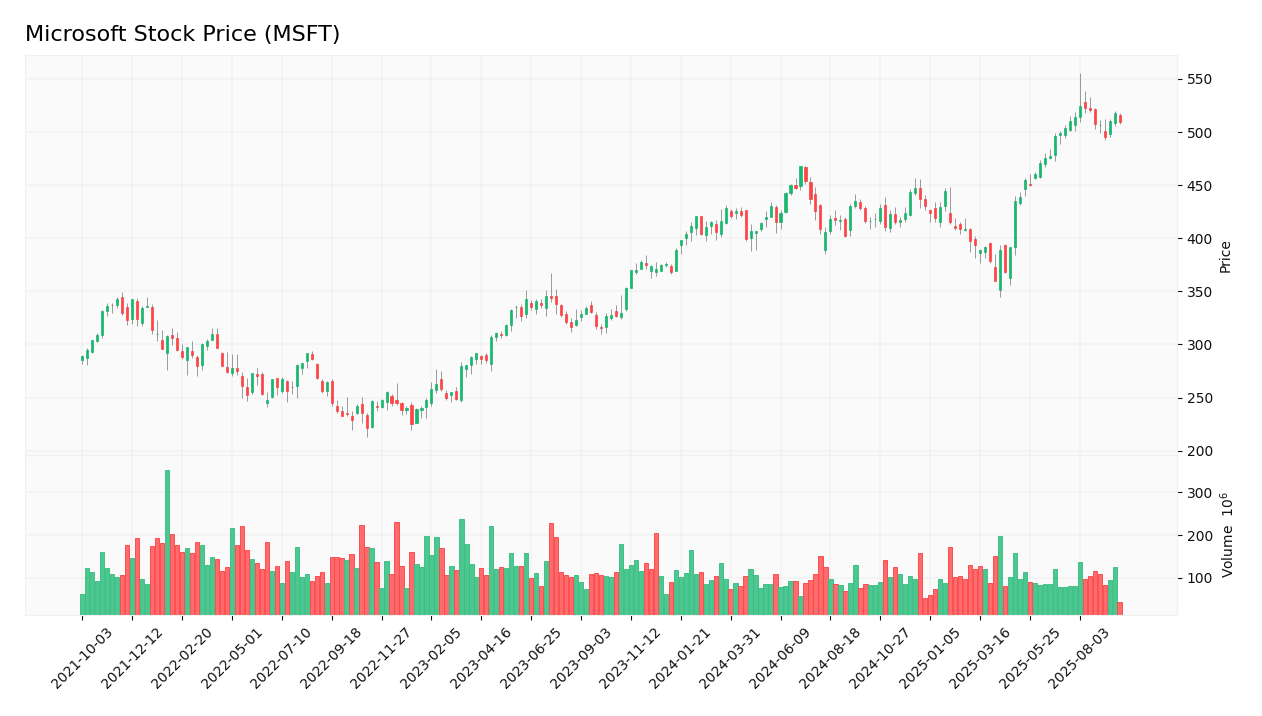

The stock price of Microsoft has shown resilience and growth over the years. Below is a chart illustrating the weekly stock price trend.

Trend Analysis

Over the past year, Microsoft’s stock price has experienced a bullish trend, increasing from approximately $247.81 in January 2023 to $510.15 in September 2025, representing a growth of about 105.5%. This upward trend indicates strong investor confidence and positive market sentiment. The stock has shown some volatility, with a 52-week range of $344.79 to $555.45, reflecting fluctuations in market conditions.

Volume Analysis

In the last three months, Microsoft has seen an average trading volume of approximately 20,490,914 shares. The volume has been relatively stable, indicating a balanced market with neither strong buyer nor seller dominance. However, the recent increase in volume suggests growing interest from investors, which could be a positive sign for future price movements.

Analyst Opinions

Recent analyst recommendations for Microsoft have been predominantly positive, with many analysts rating the stock as a “buy” due to its strong financial performance and growth potential. The consensus among analysts is that Microsoft is well-positioned to capitalize on emerging technologies and maintain its market leadership.

Consumer Opinions

Consumer feedback on Microsoft products has been largely positive, with users praising the functionality and integration of its software solutions. However, some criticisms have been directed at pricing and customer support. Below is a table comparing three positive and three negative reviews.

| Positive Reviews |

Negative Reviews |

| Excellent integration across devices. |

High pricing compared to competitors. |

| User-friendly interface. |

Customer support can be slow. |

| Robust security features. |

Some features are overly complex. |

Risk Analysis

The following table outlines the main risks faced by Microsoft:

| Risk Category |

Description |

Probability |

Potential Impact |

Recent Example / Fact |

| Financial |

Fluctuations in revenue due to economic downturns. |

Medium |

High |

N/A |

| Operational |

Disruptions in supply chain affecting product availability. |

Medium |

Moderate |

N/A |

| Sector |

Intense competition in the technology sector. |

High |

High |

N/A |

| Regulatory |

Changes in data privacy laws affecting operations. |

Medium |

High |

N/A |

| Geopolitical |

Risks associated with international operations. |

Medium |

Moderate |

N/A |

| Technological |

Rapid technological changes requiring constant innovation. |

High |

High |

N/A |

The most critical risks for investors include intense competition and the need for continuous innovation to stay relevant in the market.

Summary

In summary, Microsoft has a strong portfolio of products, impressive financial ratios, and significant competitive advantages. However, it also faces risks that investors should consider.

The following table summarizes the strengths and weaknesses of Microsoft.

| Strengths |

Weaknesses |

| Diverse product portfolio. |

High pricing compared to competitors. |

| Strong brand recognition. |

Dependence on Windows OS revenue. |

| Robust financial performance. |

Slow customer support. |

Should You Buy Microsoft?

Based on the analysis, Microsoft’s net margin is positive, the long-term trend is bullish, and buyer volumes are increasing. Therefore, it is a favorable signal for long-term investment. However, investors should remain cautious of the competitive landscape and potential risks.

Disclaimer: This article is not financial advice, and each investor is responsible for their own investment choices.

Additional Resources

Microsoft adds Anthropic AI model to Copilot assistant, diversifying from OpenAI – CNBC

Scoop: Microsoft looks to build AI marketplace for publishers – Axios

Microsoft tames intense chip heat with liquid cooling veins, designed by AI and inspired by biology – GeekWire

Vertiv Stock Falls After Microsoft Reveals ‘Breakthrough’ Chip Cooling Tech – Investor’s Business Daily

Microsoft Demonstrates Microfluid Cooling Within Future AI Chips – extremetech.com

For more information, visit Microsoft’s official website:

Microsoft.

Table of Contents

Table of Contents