Rockwell Automation and Honeywell International are two prominent players in the industrial automation sector, both vying for leadership in an industry characterized by rapid technological advancement and increasing demand for efficiency. Rockwell Automation specializes in digital transformation solutions through its extensive product offerings in control systems and data analytics. In contrast, Honeywell International operates across diversified sectors, including aerospace and building technologies, with a strong focus on innovation and sustainability. This article seeks to explore how each company positions itself in the market and which of the two may be better positioned for future growth.

Company Overview

Rockwell Automation Overview

Founded in 1903 and headquartered in Milwaukee, Wisconsin, Rockwell Automation is a leader in industrial automation and information technology. The company aims to improve productivity and sustainability for its customers through innovative automation solutions. Its operations are organized into three segments: Intelligent Devices, Software & Control, and Lifecycle Services, providing a comprehensive range of products and services designed to enhance manufacturing efficiency.

Honeywell International Overview

Established in 1906 and based in Charlotte, North Carolina, Honeywell International is a diversified technology and manufacturing company. Operating across various sectors, including aerospace, building technologies, and performance materials, Honeywell focuses on delivering innovative products that enhance efficiency, safety, and sustainability. The company’s diverse portfolio includes advanced automation solutions and safety equipment aimed at improving operational performance.

Financial Comparison

Analyzing the financial metrics of Rockwell Automation and Honeywell International reveals distinct growth trajectories and financial health indicators. Rockwell Automation is on a robust growth path, with revenue projected to reach $9 billion by 2025, while Honeywell is expected to achieve $39.5 billion in the same timeframe. Both companies exhibit strong net margins, with Honeywell slightly ahead at 15.4%. Rockwell’s return on equity (ROE) of 38.8% showcases its effective capital utilization, compared to Honeywell’s 35.7%.

| Metric | Rockwell Automation | Honeywell International |

|---|---|---|

| Revenue | $9 billion (est. 2025) | $39.5 billion (est. 2025) |

| Net Income | $1.5 billion (est. 2025) | $9.0 billion (est. 2025) |

| Net Margin | 15.0% | 15.4% |

| ROE | 38.8% | 35.7% |

| ROIC | 20.8% | N/A |

| P/E | 23.8 | N/A |

| P/B | 9.2 | N/A |

| Current Ratio | 1.46 | 1.27 |

| Payout Ratio | 39.3% | 50.5% |

| Dividend Yield | 1.65% | 2.0% |

In terms of liquidity, Rockwell’s current ratio of 1.46 indicates a strong short-term financial position, while Honeywell’s current ratio of 1.27 is also healthy but slightly lower. Honeywell’s higher payout ratio and dividend yield suggest a more aggressive return of capital to shareholders, reflecting its commitment to providing shareholder value.

Strategic Comparison

Rockwell Automation Strategy

Rockwell Automation’s strategic focus is centered around digital transformation in manufacturing. The company invests heavily in automation technologies, particularly in areas such as AI and IoT, to enhance operational efficiency for its clients. Rockwell also emphasizes strategic partnerships and acquisitions to expand its technological capabilities and market reach. Its competitive strategy revolves around providing integrated solutions that address the unique challenges faced by industrial clients, positioning itself as a comprehensive automation partner.

Honeywell International Strategy

Honeywell International adopts a diversified business model, leveraging its extensive research and development capabilities to innovate across various sectors. The company’s strategy involves enhancing product efficiency and sustainability, catering to the increasing demand for environmentally friendly solutions. Honeywell focuses on strategic partnerships and collaborations to foster innovation and improve its competitive edge. Its strong brand reputation and diverse portfolio allow it to adapt to changing market dynamics effectively.

Innovation and Sustainability

Both Rockwell Automation and Honeywell International prioritize innovation and sustainability as core aspects of their business strategies. Rockwell invests significantly in R&D, focusing on advanced automation solutions that integrate AI and IoT technologies to enhance efficiency in manufacturing processes. The company is also committed to sustainability by promoting energy-efficient solutions.

Honeywell, on the other hand, emphasizes sustainable practices across its product lines, including energy-efficient building technologies and safety solutions. The company’s R&D efforts are geared towards developing innovative products that not only improve operational performance but also reduce environmental impact. Honeywell’s sustainability initiatives are evident in its commitment to reducing carbon emissions and promoting safe working environments.

Market Performance and Valuation

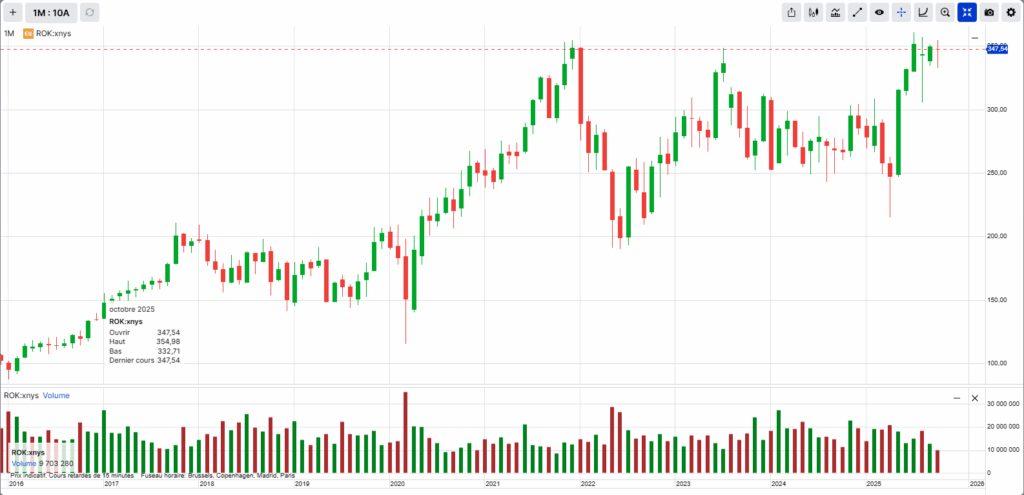

In terms of market performance, Rockwell Automation has experienced significant stock price appreciation, reflecting investor confidence in its growth potential. The stock has risen from around $215 to $347.66 over the past year, marking a 62% increase. Honeywell’s stock has shown resilience, currently trading at $202.96, with fluctuations indicating stable trading activity. Both companies have positive analyst recommendations, with Rockwell viewed favorably for its growth trajectory and Honeywell recognized for its diversified strengths.

Rockwell Automation stock

Honeywell International stock

Analyst Opinions

| Rockwell Automation | Honeywell International |

|---|---|

| Predominantly Positive | Predominantly Positive |

Strengths and Weaknesses

The comparative analysis of strengths and weaknesses highlights key differentiators between Rockwell Automation and Honeywell International. Rockwell has a strong focus on automation but operates with moderate diversification compared to Honeywell’s extensive portfolio across multiple sectors. Both companies exhibit high profitability; however, Honeywell’s innovation capabilities are recognized as particularly strong, positioning it well for future advancements. Market share reflects Rockwell’s niche in automation, while Honeywell’s diverse presence provides resilience against market fluctuations.

| Criterion | Rockwell Automation | Honeywell International |

|---|---|---|

| Diversification | Moderate | High |

| Profitability | High | High |

| Innovation | Strong | Very Strong |

| Global Presence | Established | Established |

| Market Share | 12% (Automation) | Diversified Market Presence |

| Debt Level | Moderate | Moderate |

Consumer Opinions

Consumer opinions indicate that both companies are generally well-regarded, though they face specific challenges. Rockwell Automation is praised for its product support and effectiveness, although some customers note higher pricing and complexities in product use. Honeywell receives positive feedback for its product quality and customer service but faces criticism regarding pricing and response times, which could impact customer satisfaction.

| Reviews | Rockwell Automation | Honeywell International |

|---|---|---|

| Positive Reviews | Strong product support, effective solutions | High-quality products, excellent customer service |

| Negative Reviews | Higher pricing, steep learning curve | Pricing concerns, service response times |

Conclusion

In conclusion, both Rockwell Automation and Honeywell International present compelling investment opportunities, each with unique strengths and market positioning. Rockwell’s strong focus on industrial automation and digital transformation positions it well for growth in a rapidly evolving sector. Conversely, Honeywell’s diversified approach and commitment to innovation and sustainability provide resilience and adaptability in a competitive landscape. Investors focused on growth and innovation may prefer Rockwell Automation, while those prioritizing diversification and stability might favor Honeywell International.

Sources